Overview

Looking to profit from steady market conditions? Our short volatility strategy on Walmart (WMT) leverages predictable price movements to generate attractive returns with controlled risks. Ideal for periods of stable or declining volatility, this approach has consistently delivered strong performance.

Why Walmart?

Walmart remains a retail giant with resilient performance, even amidst economic fluctuations. Recent earnings reports highlight strong sales and strategic initiatives, making WMT a reliable candidate for our volatility-based strategy.

Strategy Explained

We’re implementing a bullish short volatility strategy by:

- Selling 5 put options at a $78 strike price

- Buying 8 put options at a $75 strike price

This setup aims to earn premiums when WMT’s price stays above $78, benefiting from time decay and limited downside.

Key Metrics

- Probability of Profit: 65%

- Potential Annual Return: 141%

- Historical Annual Return: 8%

- Risk Profile: Controlled exposure with defined losses below $75

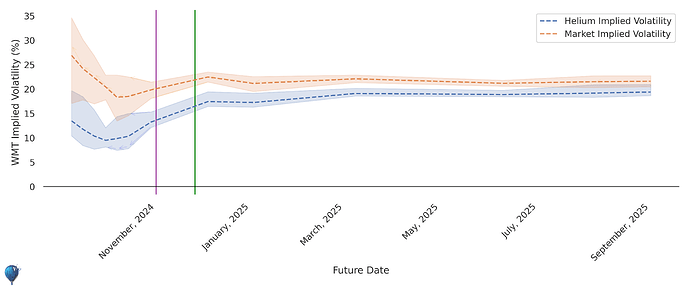

Understanding Volatility

Implied Volatility (IV) measures market expectations of WMT’s price swings. Currently, IV is lower than market averages, providing a favorable environment for our strategy.

Term Structure of Implied Volatility

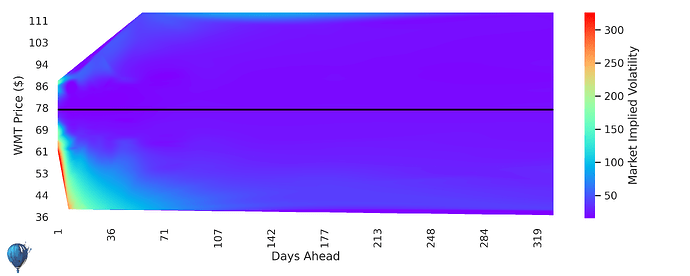

Volatility Surface

Lower IV suggests premiums are relatively high, enhancing our strategy’s attractiveness.

Potential Returns and Risks

Our trade offers a balanced risk-reward profile:

- Profit Zone: WMT stays above $78

- Risk: Limited if WMT drops below $75

- Benefit: Time decay works in our favor, reducing option values over time

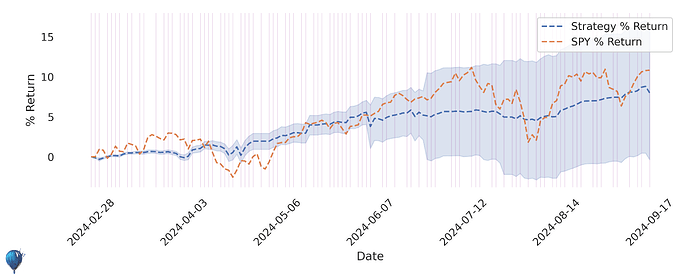

Historical Performance

Our strategy has outperformed benchmarks like SPY, demonstrating reliability and effectiveness over time.

Conclusion

Harness the power of market stability with our Walmart short volatility strategy. With a high potential return and disciplined risk management, this approach is designed for traders seeking consistent, data-driven profits.