Trade Overview

Today, we explore a strategic bearish short volatility setup for Visa (V), designed to leverage current market uncertainties and optimize annualized returns.

The Trade

- Sell: 1 Call at $272.5 strike (Delta: 0.54)

- Buy: 5 Calls at $280.0 strike (Delta: 0.12)

- Expiration: 3 days

This approach aims to capitalize on Visa’s anticipated price stability amidst ongoing regulatory pressures.

Why Visa?

Visa is currently priced around $272.93. Recent developments make it a compelling choice:

- Regulatory Challenges: A DOJ antitrust lawsuit alleges monopolistic practices, injecting uncertainty into Visa’s market position.

- Market Sentiment: Insider activity, such as Paul Pelosi’s sale of Visa shares, adds to the cautious outlook.

- Competitive Pressure: Increased rivalry in digital payments could impact growth.

Despite these headwinds, Visa’s advancements in blockchain technology and digital payment adoption present potential for operational gains.

Trade Metrics at a Glance

- Probability of Profit: 56%

- Annualized Return: 220%

- Risk-Reward Ratio: 1:0.2

- Helium Expected Edge: $39

- Strategy Historical Return: 8% annually

For a detailed forecast, visit Helium’s Visa AI Prediction.

Technical Insights

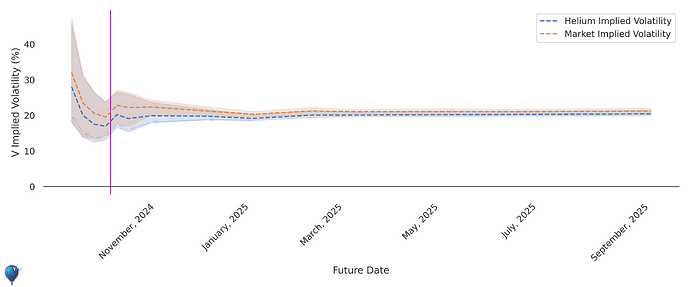

Implied Volatility

Visa’s implied volatility shows a dip in the near term, stabilizing around 20%, aligning with Helium’s projections.

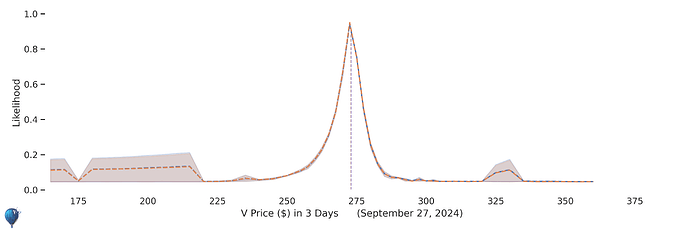

Price Stability

The forecast indicates minimal price movement, supporting a short volatility strategy.

Risk and Reward

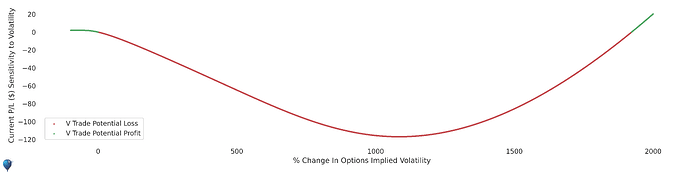

Managing Volatility

The trade balances sold and bought calls to maintain low sensitivity to volatility spikes.

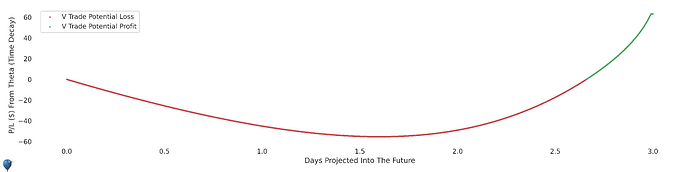

Time Decay Advantage

Significant time decay benefits are expected as the options approach expiration, enhancing profitability.

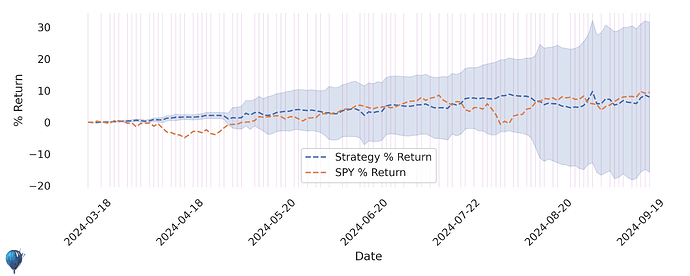

Performance History

Helium’s model consistently outperforms the market, reinforcing the strategy’s reliability.

Conclusion

This bearish short volatility strategy for Visa leverages current regulatory uncertainties and strategic technical insights to offer a high-probability trade with substantial annualized returns. By focusing on time decay and managing volatility risks, traders can navigate Visa’s turbulent landscape effectively.

For an in-depth analysis and to refine your trading approach, visit Helium’s Visa Trade Forecast.

Happy Trading!

Join the discussion and share your thoughts on this strategy below!