Why This Trade Makes Sense

As of September 30, 2024, Dell Technologies (DELL) is trading at $118.55. Recent company policies, including a strict return-to-office mandate and significant layoffs, have sparked uncertainty. Coupled with intense competition in AI and cloud services, these factors create an opportunity for a bearish options strategy.

Trade Setup: Short Volatility with Protective Tail

Strategy: Sell volatility with long-tail protection

Expiration: October 5, 2024 (4 days)

Positions:

- Sell: 1 Call option at $119 strike

- Buy: 8 Call options at $130 strike

Key Metrics:

- Probability of Profit: 63%

- Annualized Return: 143%

- Risk/Reward: Potential to earn 0.2 per dollar risked

Explore Helium’s Dell Forecast

Why It Works

Stock Performance & Sentiment

- Recent Dip: Dell has fallen ~17% in the last 90 days, hinting at potential rebound.

- Employee Morale: Strict policies have created uncertainty, possibly impacting performance.

Options Market Analysis

- Trading Volume: Calls are 42% more active than puts, indicating bearish sentiment.

- Implied Volatility: Helium’s models show higher volatility than the market expects, favoring a volatility sell.

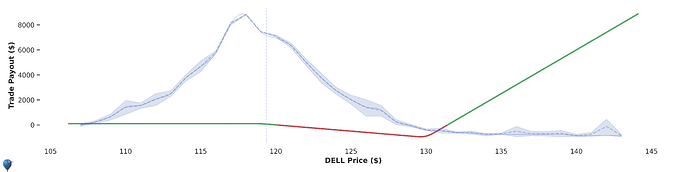

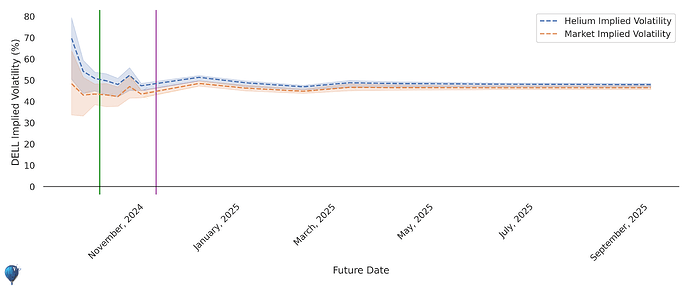

Visual Insights

Risk Structure

This graph illustrates the trade’s risk-reward profile, highlighting limited downside and significant upside protection.

Implied Volatility Comparison

Helium’s implied volatility is higher than the market’s, suggesting an underpriced volatility premium.

Potential Risks

- Positive News: Advancements in AI or enterprise tech could drive the stock up unexpectedly.

- Market Shifts: Further corporate restructuring or external economic factors might alter the trade’s outlook.

Conclusion

This bearish short volatility strategy on Dell offers an attractive annualized return with controlled risk, leveraging market mispricing and robust data insights from Helium. It’s a compelling option for traders looking to capitalize on Dell’s current volatility and market sentiment.

For a detailed analysis, visit Helium Trades’ Dell Forecast.