Navigating Airbnb’s (ABNB) volatile landscape requires a thoughtful approach. Today, we explore a strategic bearish trade that combines short volatility with long-tail convexity, tailored for an 11-day horizon.

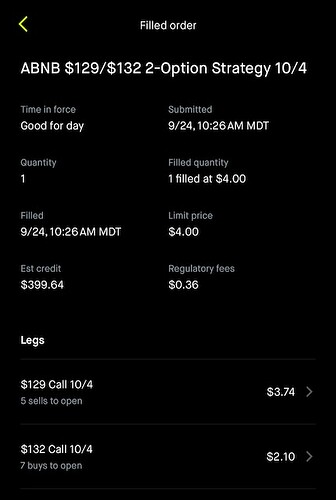

Trade Snapshot

- Strategy:

- Sell 5 Call Options at $129.0 strike (Delta: -0.52)

- Buy 7 Call Options at $132.0 strike (Delta: +0.34)

- Probability of Profit: 61%

- Risk-Reward Ratio: 1:0.3

- Annualized Return: 167%

- Historical Annual Return: 17%

- Expected Edge:

- Market: $17

- Helium: $62

- Key Greeks:

- Delta: -21.2

- Theta: -15.9

- Vega: +13.1

- Gamma: +9.5

Explore Helium’s ABNB Forecast

Market Context

Current Sentiment

- Price Today: $129.03

- Up 0.2% from last week

- Down 14.0% over the past 90 days

- Trading Volume: Minimal for options, suggesting low activity and potential volatility opportunities

- Price Trend: Exhibiting mean-reversion, indicating possible rebounds after declines

Influencing Factors

-

Bearish Drivers:

-

Increased regulatory scrutiny

-

Rising competition impacting growth

-

Geopolitical tensions, such as the recent Hezbollah conflict, dampening travel demand

-

Bullish Considerations:

-

Advancements in AI and safety measures enhancing user trust

-

Long-term growth prospects despite short-term downturns

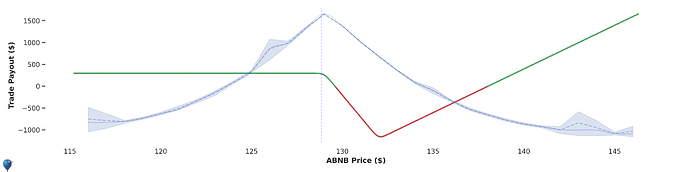

Why This Strategy?

This bearish strategy leverages the current low trading volume and mean-reverting price trend. By selling call options, we capitalize on potential overpricing in market volatility, while the long-tail convexity offers protection against significant upward movements.

Data Insights

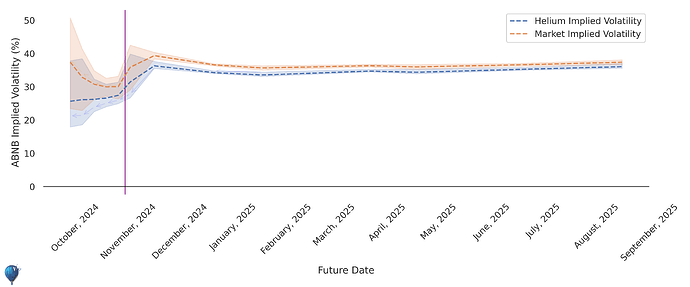

Implied Volatility

Helium’s implied volatility is consistently lower than the market’s, presenting an opportunity to sell volatility.

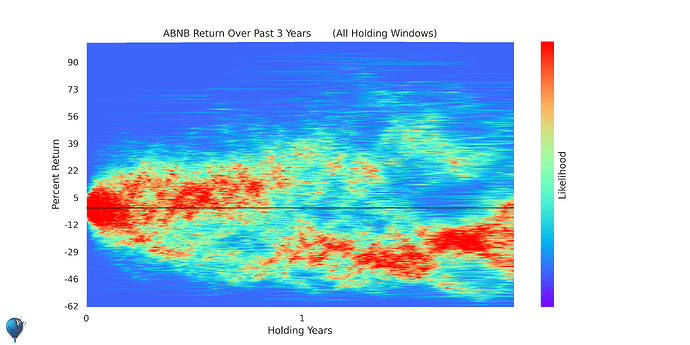

Historical Returns

Historical data shows a tendency for negative returns within the 11-day window, supporting a bearish stance.

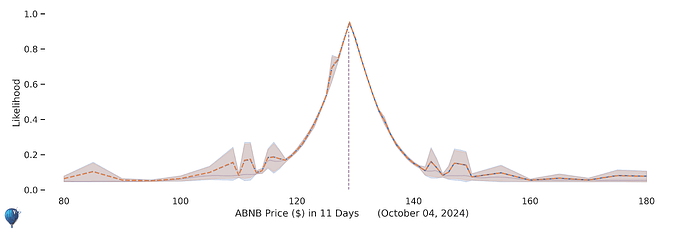

Future Price Projections

Helium forecasts stable pricing with reduced chances of extreme movements, enhancing the trade’s reliability.

Potential Outcomes

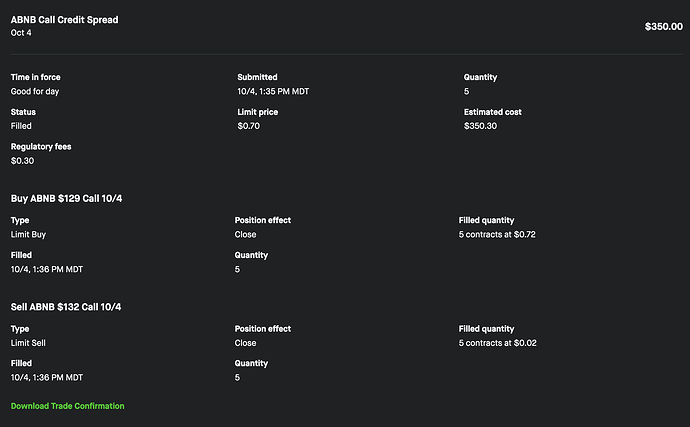

- Profit Zone: 29% return within 11 days, annualizing to 167%

- Risk Management: The strategy is hedged to minimize losses unless there are significant upward price spikes

The payout structure highlights a favorable risk-reward balance.

Conclusion

This bearish strategy on ABNB is backed by robust analysis and favorable market conditions. With a strong probability of profit and substantial annualized returns, it offers a compelling opportunity for traders looking to capitalize on Airbnb’s current trends.

Dive deeper into this strategy and access more insights with Helium Trades.

“All I know is that I know nothing,” embracing humility is key in the dynamic world of trading.