Why Starbucks Now?

Under CEO Brian Niccol, Starbucks is driving innovation and strengthening its market position. Recent initiatives, such as eliminating non-dairy milk charges and introducing new festive offerings, have boosted consumer loyalty. Additionally, despite external challenges like labor disputes, the company’s strategic moves and positive market sentiment present a timely options opportunity.

Trade Setup: Bullish Short Volatility

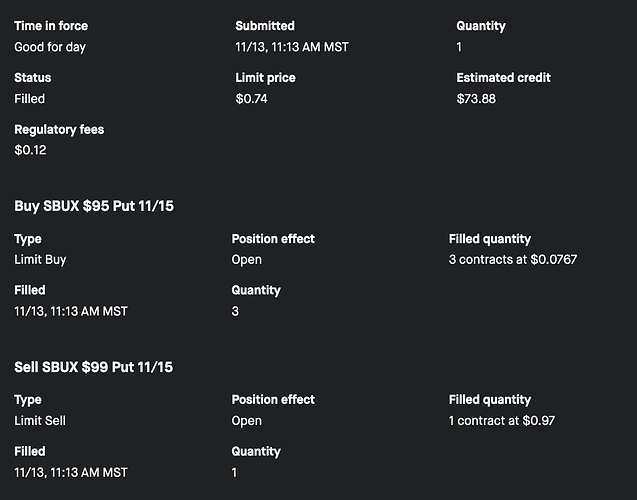

Expiration Date: November 15, 2024

Strategy: Bullish Short Volatility with Long Tail Convexity

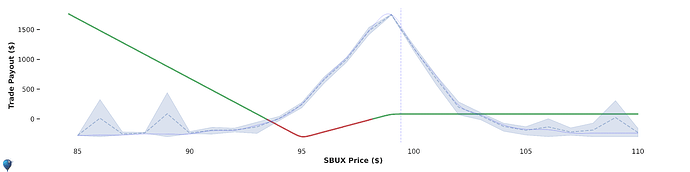

- Sell 1 Put @ $99 Strike

- Buy 3 Puts @ $95 Strike

Key Metrics

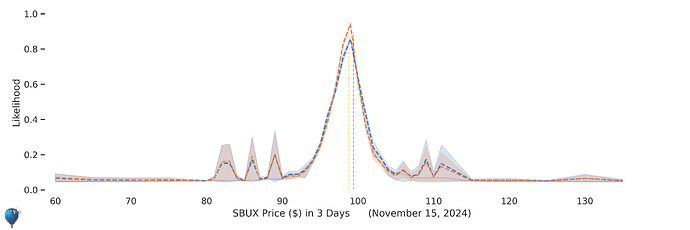

- Market Probability of Profit: 59%

- Helium Probability of Profit: 61%

- Potential Return: 32% (Annualized: 352%)

- Initial Delta: $21

Full details on Helium Trades.

Why This Trade?

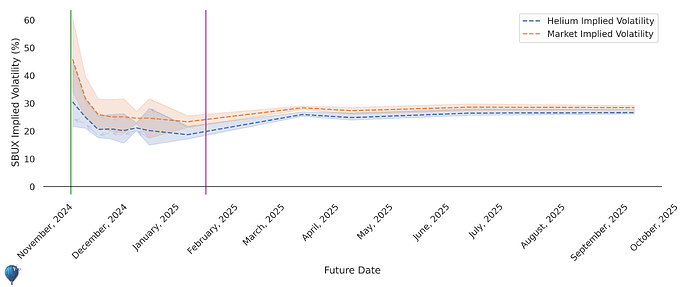

Implied Volatility Drop

Implied volatility has sharply declined, favoring a short volatility approach. Lower volatility reduces the premium decay risk.

Profit Potential

The payout structure maximizes gains if SBUX stays between $99 and $105, aligning with bullish market forecasts.

Price Dynamics

Forecasts indicate strong support around current levels, with Helium’s AI predicting a steady price trajectory towards expiry.

Risk Management

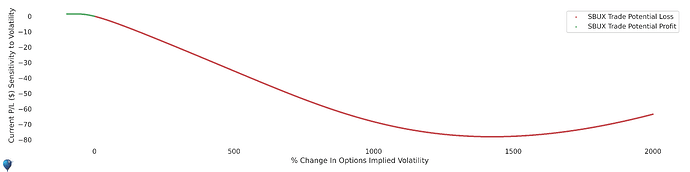

Vega Sensitivity

The strategy is resilient to volatility increases, minimizing adverse effects from sudden market shifts.

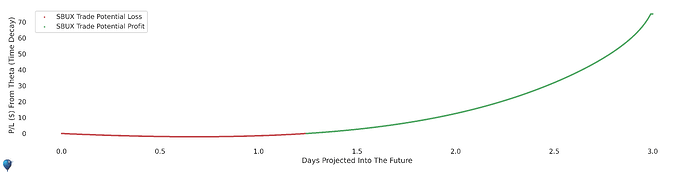

Time Decay Advantage

Profits benefit from theta decay, accelerating as expiration approaches, enhancing returns over the short term.

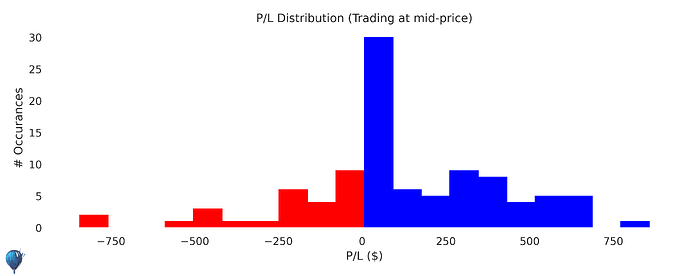

Historical Performance

Past trades show a positive skew, indicating a higher probability of gains versus losses.

Strategic Insights

Starbucks’ stable price action combined with innovative strategies and increasing call option volume suggest upward momentum. While labor disputes pose risks, current market trends and company initiatives provide a robust foundation for this bullish strategy.

Conclusion

This options trade leverages Starbucks’ recent strategic advancements and favorable market conditions. With a high annualized return and solid risk management, it presents a compelling short-term opportunity. For detailed analysis and forecasts, visit Helium Trades.