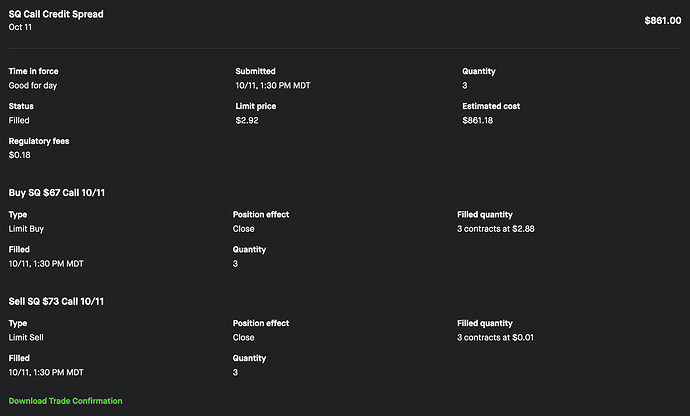

Trade Snapshot

Strategy: Bearish Short Volatility with Convexity

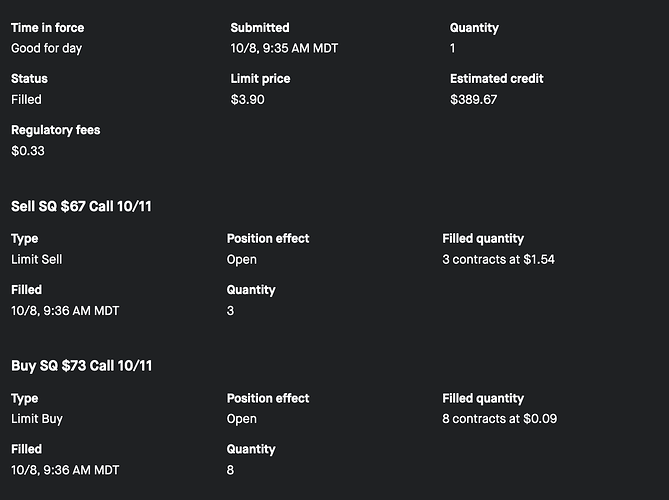

Expiry: October 11, 2024

Positions:

- Sell 3 Call Options @ $67

- Buy 8 Call Options @ $73

Annualized Potential Return: 124%

Probability of Profit: 71%

Helium Forecast: SQ AI Forecast

Why This Trade?

Square (SQ) has shown mean-reverting price behavior, making it ripe for a short volatility strategy. Despite high call volumes (70% calls vs. puts), increasing competition and regulatory pressures paint a bearish outlook. This setup leverages time decay and controlled risk through higher strike hedges.

Market Context

Recent Developments

- Price Action: SQ is stabilizing around support levels, favoring strategies that benefit from reduced volatility.

- Competitive Landscape: Rising competition and stricter regulations are weighing on investor sentiment.

- Earnings Catalyst: Upcoming earnings on October 11 can trigger volatility, aligning with the trade’s expiry.

Broader Sentiment

Digital payments are growing, but regulatory scrutiny tempers optimism. This mixed environment creates opportunities for strategic options plays.

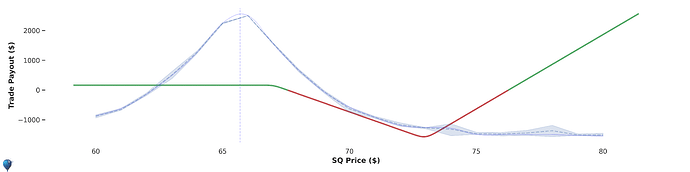

Strategy Breakdown

Key Metrics

- Market Expected Edge: $12

- Helium Expected Edge: $33

- Annualized Return: 124%

Risk Structure

- Profit Zone: Below $67

- Risk Mitigation: Higher strikes limit losses above $73

Greeks Explained

- Delta (-77.3): Neutralizes upward price movements.

- Theta (+14.7): Gains from time decay.

- Vega & Gamma: Slightly negative, stable as expiration approaches.

Data Insights

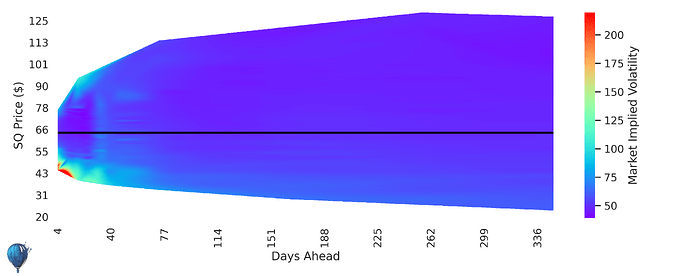

Implied Volatility

SQ’s volatility structure indicates potential for price stability until expiry.

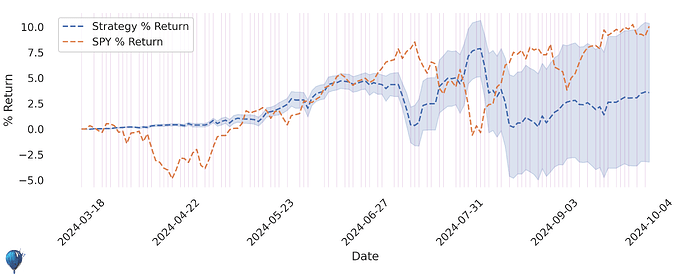

Historical Performance

Consistent returns compared to SPY benchmarks highlight the strategy’s effectiveness.

Conclusion

This SQ options trade offers a balanced risk-adjusted opportunity with a strong annualized return. By leveraging Helium’s data-driven insights, traders can effectively navigate the current market landscape.

Explore More: Helium Trades Forecast for SQ

Remember, markets are unpredictable. Approach each trade with informed caution.