Helium Trades designs portfolios that are short vega, long gamma aka short perception of risk and long realized risk.

1. What We’re Actually Doing

Helium is long things actually happening, and short the market’s perceptions of what might happen

-

Vega = Cost of uncertainty imagined (implied volatility).

-

Gamma = Payoff from uncertainty unfolding (movement of the underlying).

-

Short vega, long gamma = Sell overpriced imagination, own cheap reality.

Helium seeks out tickers where the market is under-pricing the tails of distribution (big underlying moves), and over-pricing the shoulders of the distribution (small underlying moves).

2. The Ratio Backspread — Our Weapon of Choice

How do we get to a short vega, long gamma portfolio?

We will sell an options spread for a net credit (usually), where we are long convexity and long more options than we are short.

| Leg | Typical Δ | Action | Why |

|---|---|---|---|

| Short 1–2 near ATM | ~50 Δ | Sell | Overpriced uncertainty |

| Long 3–5 far OTM | ~10 Δ | Buy | Cheap convexity |

P&L for Short Leg

This Leg Could Make money if:

- Implied volatility decreases (we are short vega)

- Underlying moves and we are directionally correct (this trade carries delta)

- Time endures without much happening (we are long theta)

P&L for Long Leg

This Leg Could Make money if:

- Implied volatility increases (we are long an option and long skew)

- Underlying moves and we are directionally correct

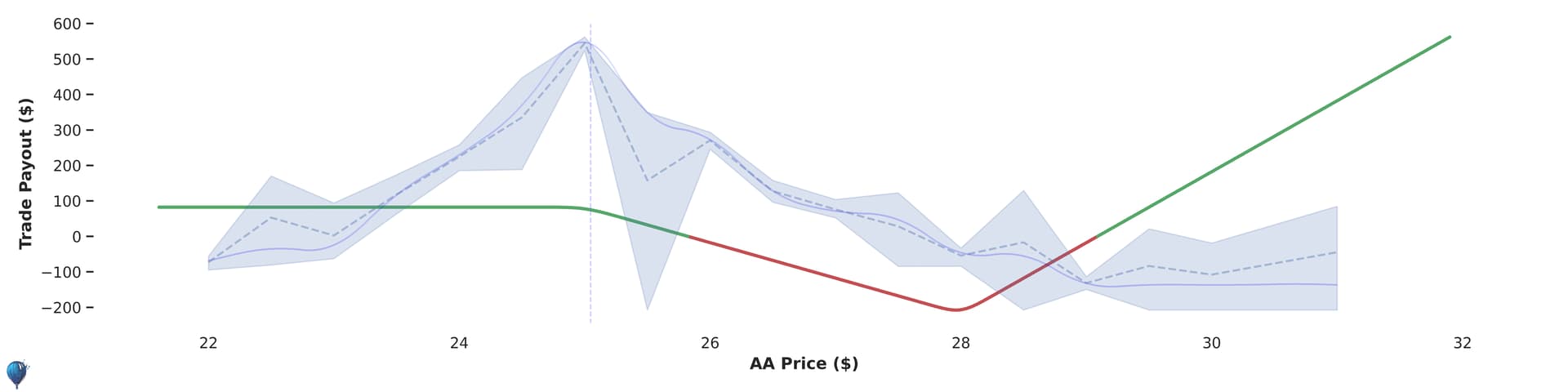

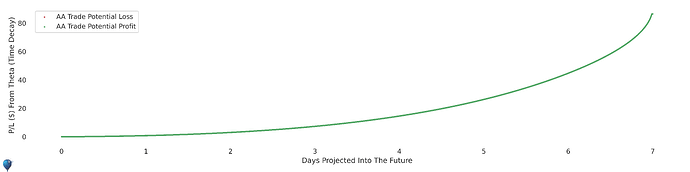

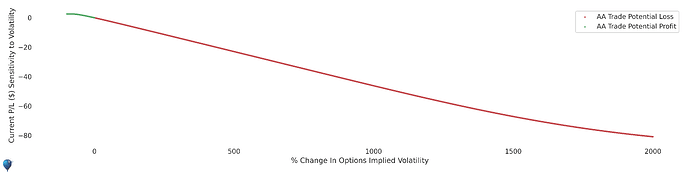

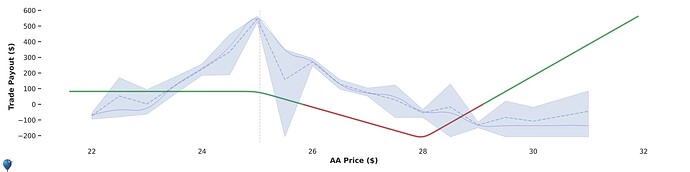

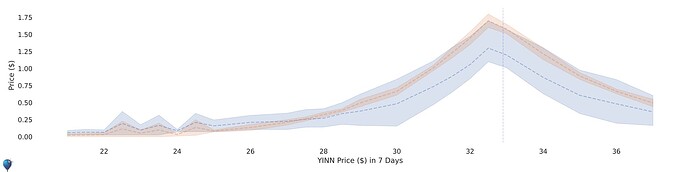

Trade Risk Profiles

Theta (Time) Risk

Vega (Implied Volatility) Risk

Delta (Underlying Price Movement) Risk

3. Why It Works: The Mispricing of Fear

Markets are messy approximations of human belief:

-

Fear overprices downside volatility.

-

Greed overprices upside volatility.

-

Boredom underprices both.

By setting up a ratio backspread:

-

We short what people fear might happen.

-

We own what actually could happen.

This isn’t about picking direction (although delta offers another way to win)

It’s about picking mis-priced emotions.

4. Calls, Puts, Doesn’t Matter — Only Uncertainty Matters

Put Backspread:

Short panic → Long crash.

(Good for long delta bias. Sell insurance, own catastrophe.)

Call Backspread:

Short euphoria → Long melt-up.

(Good for mean-reverting bubbles. Sell hopium, own blowups.)

Helium generally skews slightly long delta —

because markets drift up over time, but fear never sleeps.

5. What Happens When It Moves?

Big move?

→ Gamma explodes. Long OTM options light up.

Small drift?

→ Short vega wins. Time decay is your paycheck.

We scalp delta if needed (same as early-profit taking). We adjust if path dependency matters (same as having a stop loss on our short option).

But most of the time, the structure self-heals:

If you’re short peoples' dreams and long reality,

You don’t need to predict the dream.

You just need to be awake when the world turns.

TL;DR

| Element | Summary |

|---|---|

| Philosophy | Short overpriced uncertainty. Long realized events. |

| Structure | Sell 1–2 × 50Δ, buy 3–5 × 10Δ, same expiry. |

| Bias | Slightly long delta preferred. |

| Win States | Small moves → credit pocketed. Big moves → convexity payday. |

| Risk | Known, limited by stop losses on short option. |

Short vega, long gamma is a bet against the hallucinations of crowds.

Helium doesn’t guess better.

We price better.

Helium’s Short Volatility Dashboard hunts for these types of trades every day.