Overview

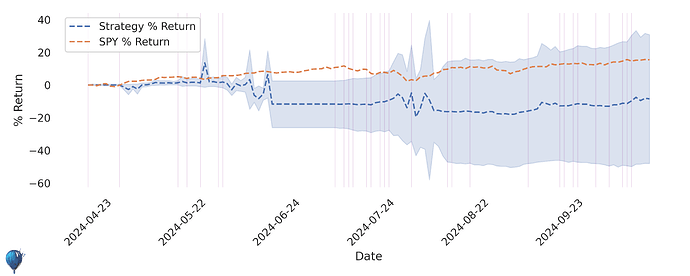

On October 22, 2024, we introduce a bullish short volatility options strategy for SABR, expiring on November 16, 2024. This approach leverages SABR’s tendency to revert to its mean, capitalizing on current high implied volatility and recent positive momentum.

Trade Structure

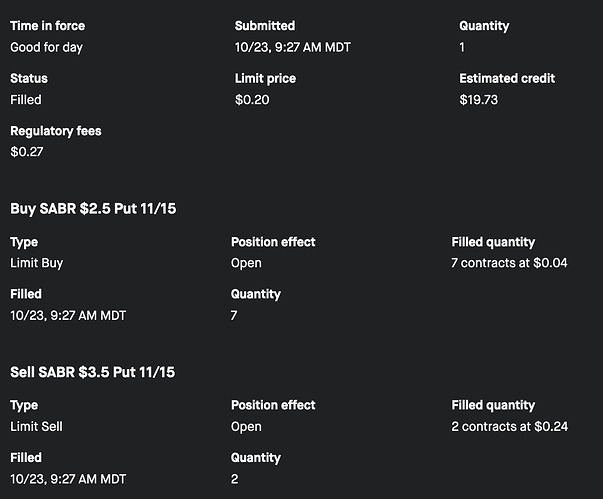

Position Details

-

Sell 2 Put Options

Strike: $3.5

Delta: -0.41 -

Buy 7 Put Options

Strike: $2.5

Delta: -0.08

Potential Returns

- 25-Day Return: 16%

- Annualized Return: 61%

- Probability of Profit: 71%

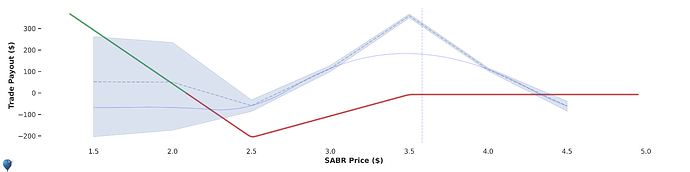

Risk Profile

This graph illustrates the profit zones, showing favorable outcomes as SABR’s price rises. The structure aligns with our short volatility stance, offering a buffer against price fluctuations.

Key Metrics

- Expected Edge: Market expects $14, Helium forecasts $44

- Initial Delta: $26.5

- Theta: -0.8

- Vega: 0.2

- Gamma: 9.4

These metrics indicate a balanced approach, benefiting from time decay while maintaining sensitivity to price movements.

Market Context

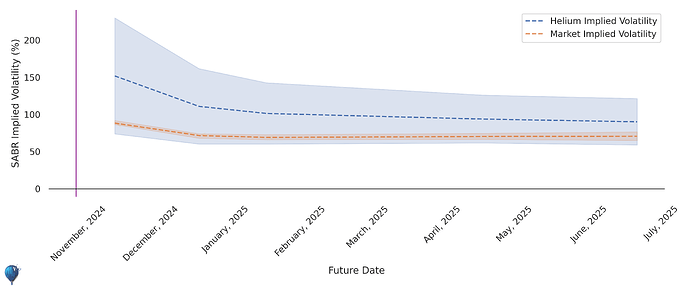

SABR is currently trading at $3.67, up 11.6% over the past month. Despite a significant -83.2% change over five years, recent volumes show a 38% increase in call options, reflecting renewed bullish sentiment. High implied volatility, as shown below, supports our short volatility strategy by anticipating a decline.

Recent Developments

Recent partnerships and strong support at $3.00 have bolstered market confidence, making SABR a compelling candidate for this mean-reverting trade.

Risks

While the outlook is positive, SABR has experienced a -9% historical return, underscoring the need for cautious optimism. Traders should remain vigilant of any adverse market shifts.

Conclusion

This SABR strategy combines bullish sentiment with a short volatility approach, underpinned by data-driven insights and historical performance. With expiration on November 16, 2024, the setup offers substantial annualized returns and a favorable probability of profit.

For more details and forecasts, visit Helium Trades.