Qualcomm (QCOM) is presenting a strategic options opportunity amidst recent market developments. Leveraging Helium’s insights, this trade aims to benefit from declining volatility driven by company-specific news and broader market trends.

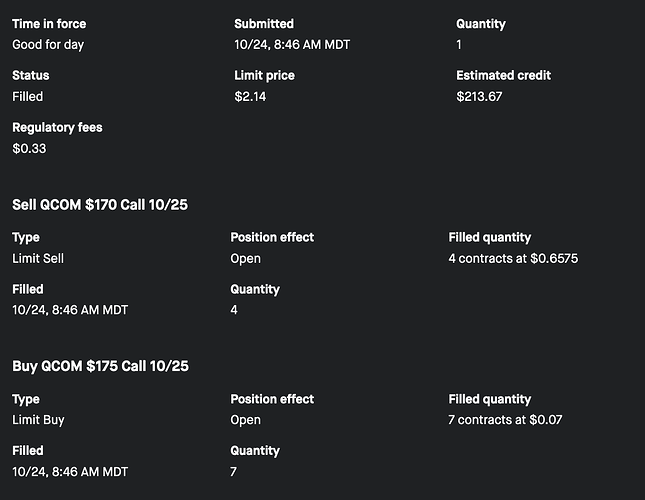

Trade Setup

Date: October 23, 2024

Expiry: October 25, 2024

- Sell: 4 QCOM $170 Call Options

- Buy: 7 QCOM $175 Call Options

This short volatility strategy benefits if QCOM’s stock remains below $170, allowing premium collection with limited downside.

Why This Trade?

Market Conditions

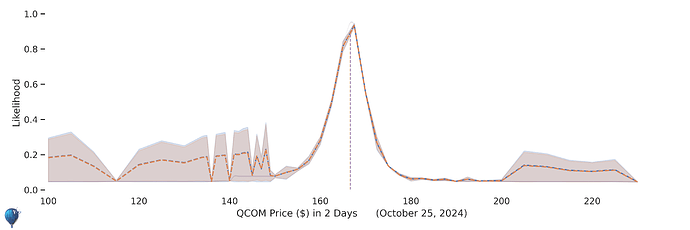

- Stock Price: QCOM is trading around $166.6, down from a 90-day high of $180.05.

- Implied Volatility: Currently below market expectations, suggesting potential for volatility to decrease.

Company News

- Licensing Dispute: Ongoing issues with Arm introduce uncertainty.

- Smartphone Sales: Global sales are slumping, adding bearish pressure.

These factors create an environment where reducing volatility can be profitable.

Key Metrics

| Metric | Value | Explanation |

|---|---|---|

| Profit Probability | 65% (Market), 66% (Helium) | Likelihood of the trade being profitable |

| Risk-Reward Ratio | 1:0.1 | For every $1 risked, potential return is $0.10 |

| Expected Edge | $15 (Market), $27 (Helium) | Projected advantage based on analysis |

| Annualized Return | 162% | Projected return if similar trades are repeated annually |

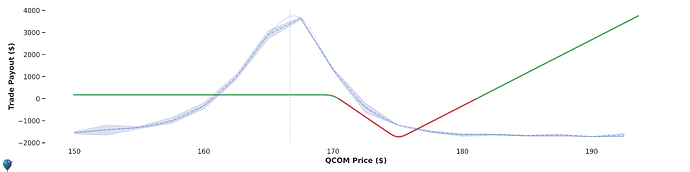

Risk Structure

Understanding the potential risks is crucial. The risk structure graph below illustrates the profit and loss landscape of this strategy.

- Breakeven Point: Around $170

- Maximum Loss: Limited by the bought calls at $175

- Profit Potential: Premiums collected from sold calls

Potential Outcomes

- QCOM < $170: Maximum profit as options expire worthless.

- $170 ≤ QCOM < $175: Partial profit as sold options start to incur losses, offset by bought options.

- QCOM ≥ $175: Losses are capped by the bought calls.

Why Choose This Strategy?

- High Probability of Profit: Over 65% chance based on market and Helium’s analysis.

- Controlled Risk: Limited downside with the purchase of higher strike calls.

- Favorable Theta Decay: Time decay works in favor over the short two-day horizon.

Explore Further

Dive deeper into Helium’s QCOM AI forecast for comprehensive insights: Helium QCOM Forecast

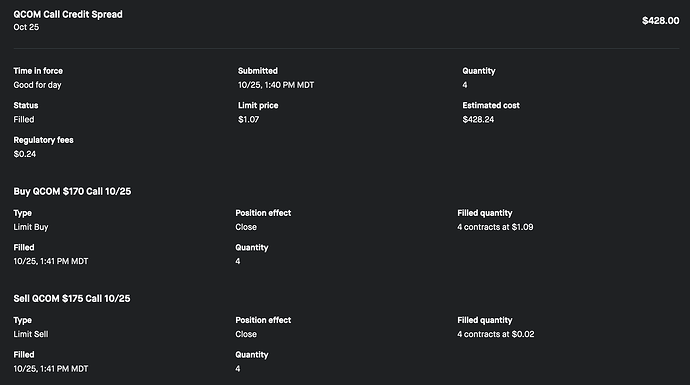

Conclusion

This QCOM options strategy leverages current market volatility trends and company-specific factors to offer a high-probability, controlled-risk trade. By selling $170 calls and buying $175 calls with a short expiry, traders can potentially achieve significant annualized returns while mitigating downside risks.

Harness Helium’s data-driven strategies to navigate the complexities of options trading with confidence.