Trade Overview: Strategic Bullish Position

ON Semiconductor (ON) is currently trading at $74.70, presenting a timely opportunity for a bullish options strategy. With the electric vehicle (EV) sector driving steady demand and strategic partnerships strengthening ON’s market position, this trade leverages these positive trends while managing volatility.

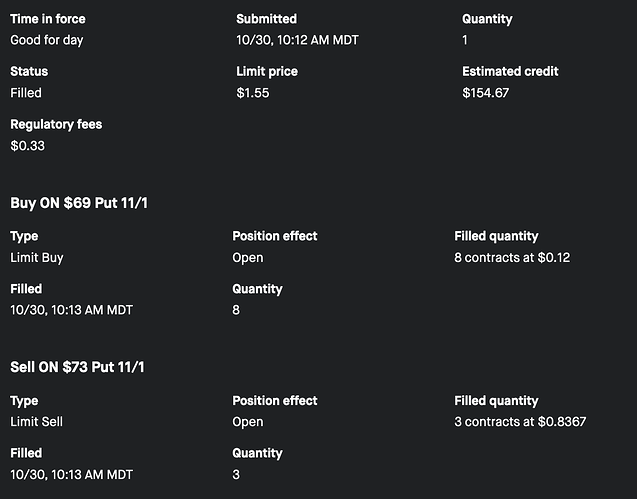

Strategy Breakdown

- Sell 3 Put Options at a $73.00 strike price

- Buy 8 Put Options at a $69.00 strike price

- Expiration Date: November 1, 2024

Key Metrics:

- Probability of Profit: 65%

- Annualized Return: 121%

- Risk-Reward Ratio: Risking 1 to potentially make 0.1

For a detailed strategy and forecast, visit Helium Trades ON Forecast.

Why This Trade Makes Sense Now

The semiconductor industry is experiencing significant growth, primarily fueled by the EV boom. ON Semiconductor benefits from this trend through:

- Steady EV Demand: Increasing production of electric vehicles drives the need for semiconductors.

- Strategic Partnerships: Collaborations enhance ON’s market reach and technological capabilities.

- Market Sentiment: Recent data shows a 36% higher bullish sentiment compared to bearish views.

However, it’s essential to remain cautious of potential geopolitical tensions and regulatory changes that could impact the market.

Understanding the Trade

Risk Structure

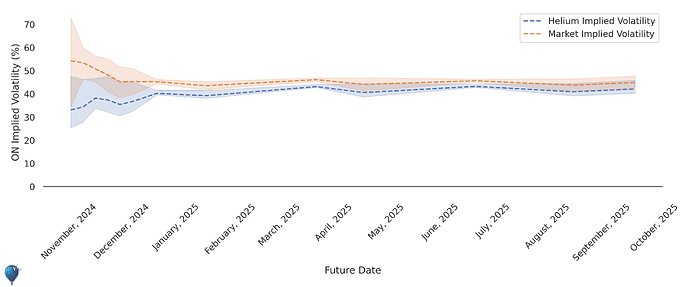

The risk structure graph highlights that ON’s implied volatility is slightly below the market average. This suggests that options are relatively cheaper, making it an attractive time to sell volatility.

Probability and Payoff

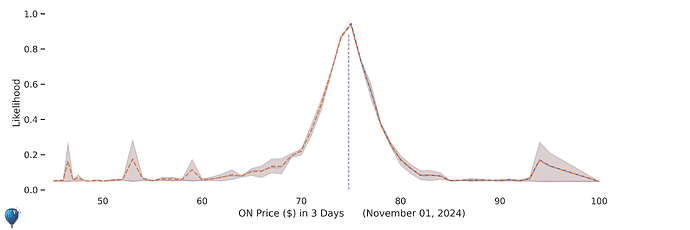

The probability density indicates that ON’s future price is likely to stay within a favorable range, aligning with Helium’s predictions. This supports the strategy of selling puts, as the chances of the stock dropping below the strike price are limited.

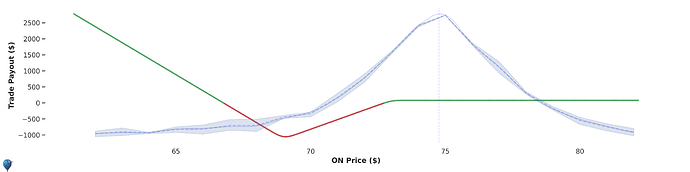

The payout profile demonstrates a high probability of profit. The majority of potential outcomes fall within the green zone, indicating profitability even if there are minor price fluctuations.

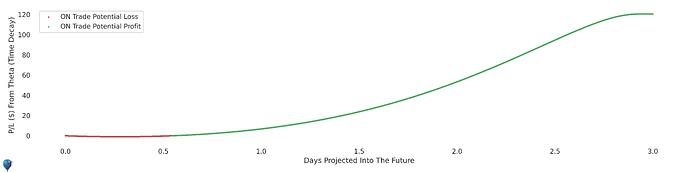

Managing Volatility and Time

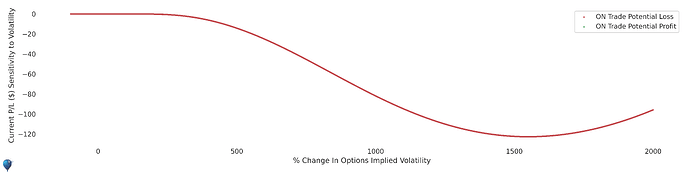

The strategy has a flat vega profile, meaning it’s not significantly affected by changes in volatility. This makes the trade more stable against unexpected market swings.

Theta, or time decay, works in favor of this strategy. As the options approach expiration, the time value diminishes, increasing the position’s value and enhancing potential profits.

Market Context and News

The semiconductor sector is poised for growth in 2025, driven by:

- Increased Chip Production: Expansion in mature chip manufacturing supports long-term demand.

- China’s Market Dynamics: While there’s a potential for oversupply, ON’s specialized focus provides a competitive edge.

Recent strategic alliances and advancements in chip technology further bolster ON’s prospects, making it well-positioned to capitalize on industry trends.

Potential Risks

While the outlook is positive, consider the following risks:

- Geopolitical Tensions: Could disrupt supply chains and affect market stability.

- Regulatory Changes: New policies might impact operations and profitability.

- Market Volatility: Unexpected shifts could influence stock performance beyond expectations.

Conclusion: A Thoughtful Approach

This options strategy leverages ON Semiconductor’s strong market position and favorable industry trends. By selling put options, you benefit from the stock’s steady performance while managing risk through strategic strikes and hedges.

Embrace a data-driven approach with insights from Helium Trades ON to enhance your decision-making process. Remember, while the strategy is grounded in solid analysis, always consider the inherent uncertainties in the market.

Expiry Date: November 1, 2024

For more insights and continuous updates on ON Semiconductor trades, explore Helium Trades ON Forecast.