NextEra Energy Bearish Short Volatility Play: A Nuanced Approach

Trade Details:

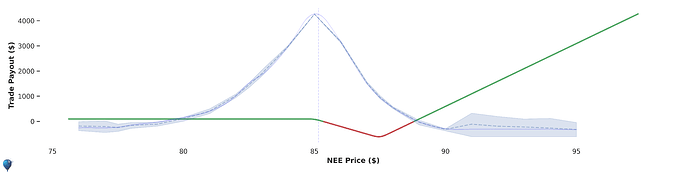

- Sell 3 $85.0 strike call options (delta: 0.51)

- Buy 8 $87.5 strike call options (delta: 0.16)

- Expiration: ~3 days

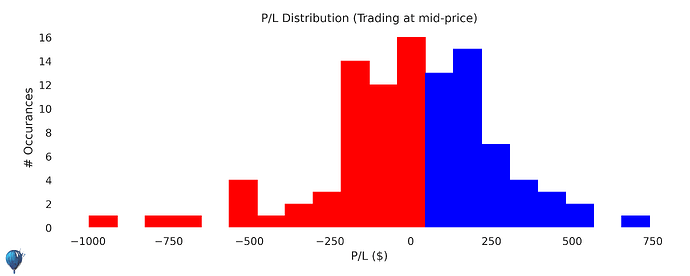

- Market Odds of Profit: 66%

- Helium Odds of Profit: 66%

- Return of Risk: 1 to make 0.2

- Potential Return: 23% (Annualized: 253%)

- Expected Edge: Market: $21, Helium: $34

- Complete Trade Forecast

Why This Trade?

1. Strategic Setup

Leveraging Helium’s top-performing models, this setup has a built-in edge with a respectable probability of profit. The trade is designed to capitalize on short-term volatility fluctuations while capturing long tail convexity – meaning profit potential spikes if NEE moves outside the expected range without exposing to outsized risks.

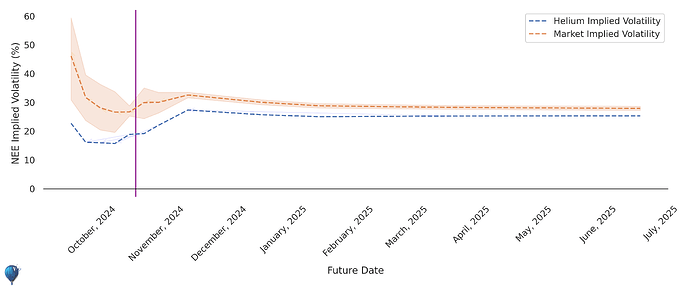

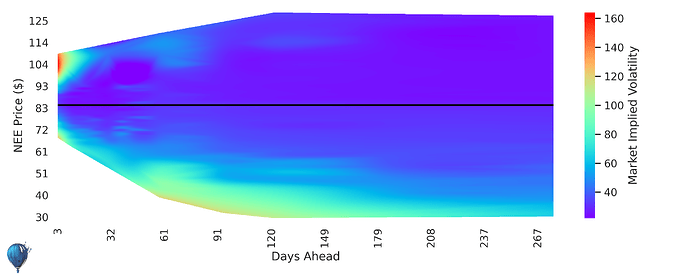

2. Volatility Insights

The term structure shows market-implied volatility exceeding Helium’s projections. This divergence suggests smart selling opportunities, as market volatility appears overestimated.

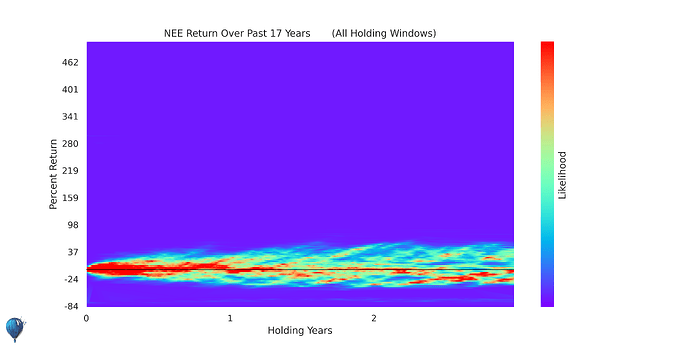

3. Historical Mean Reversion

NEE’s price action has historically been mean-reverting. This trait aligns with our bearish volatility approach, where leveraging potential reversion within a narrow 3-day window appears promising.

4. Near-Term Mean Reversion Confirmed

Today’s AI forecast for NEE is slightly positive at +0.1%, which historically correlates poorly with realized price changes. Trading volume is unusually low, implying less resistance to mean reversion in the current environment.

5. Risk vs Reward Analysis

The trade payout graph showcases how the strategy profits most if the price remains stable or slightly dips. However, a move past $87.5 inflicts limited damage due to purchasing more higher-strike calls, capping our downside.

6. The Option Greeks

- Delta: -26.3

- Theta: -28.8

- Vega: 5.6

- Gamma: 30.2

These metrics highlight a slight profitability erosion over time but manageable exposure to implied volatility shifts. Theta decay becomes less threatening at the nearer expiration date, aligning well with this short volatility viewpoint.

Broader Context & Fundamentals

While NEE has strong long-term renewable energy prospects, short-term challenges like high interest rates and possible legal hurdles could exert short-term pressure:

-

Bearish Factors: Recent bullish sentiment appears vulnerable, with looming interest rate pressures and legal uncertainties.

-

Upcoming Catalysts: Investors should monitor regulatory updates and any potential interest rate shifts, which could swing sentiment and volatility.

Conclusion

With balanced risk-reward dynamics and a keen focus on short-term mean reversion, this trade offers a nuanced yet compelling approach to capitalizing on current market nuances around NEE. Check out the Helium Trade Forecast for deeper insights.

Always remember, “All I know is that I know nothing” – humility and continuous learning drive informed trading decisions.