Why This Trade Stands Out

Navigating Mosaic Company (MOS) options offers a promising opportunity amid current market dynamics. Leveraging Helium’s AI forecast, this strategy balances risk and reward effectively, aiming for a strong annualized return.

Trade Overview

Strategy: Bullish Short Volatility

Expiration: November 4, 2024

- Sell 3 Put Options at $26.5 strike

- Buy 8 Put Options at $25.0 strike

This setup benefits from declining volatility while protecting against significant downturns.

Key Metrics

- Probability of Profit: 68%

- Annualized Return: 114%

- Option Expiry: November 4, 2024

Market Context

As of October 24, 2024, MOS trades at $26.725, below its historical highs but supported by strong agricultural demand and favorable regulatory moves. Increased call option volumes indicate bullish sentiment, aligning with our strategy.

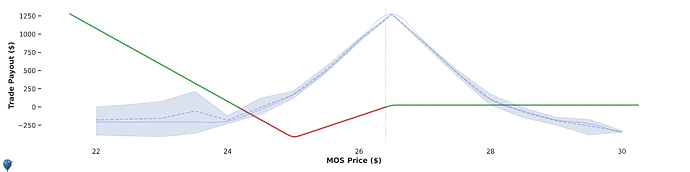

Risk Structure

The risk graph highlights potential outcomes, emphasizing limited downside and substantial upside potential. A stable or modestly rising MOS price by expiry maximizes returns.

Visual Insights

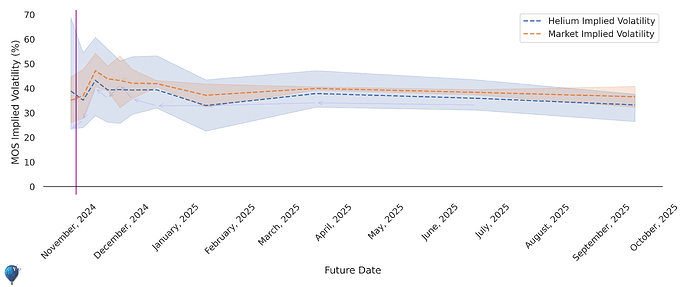

Implied Volatility Term Structure

Declining volatility supports premium decay, favoring our short positions.

Payout Analysis

Shows breakeven points and profit zones, illustrating clear paths to gains.

Why It Works

- Balanced Risk: Combining sold and bought puts mitigates large losses.

- Time Decay Advantage: Theta benefits as options near expiration.

- Volatility Decline: Vega exposure profits from decreasing market volatility.

Conclusion

This MOS options strategy offers a compelling balance of risk and reward, underpinned by robust data and market sentiment. With an impressive annualized return potential and protective measures in place, it stands out as a strategic choice for bullish traders.

Explore the full strategy and live analytics on Helium Trades.