Introduction

With Microsoft (MSFT) navigating a dynamic landscape of AI advancements and regulatory challenges, a strategic options play emerges for Helium traders. This bearish short volatility strategy leverages current market conditions, offering compelling annualized returns while managing risk effectively.

Explore detailed forecasts on Helium Trades.

Trade Overview

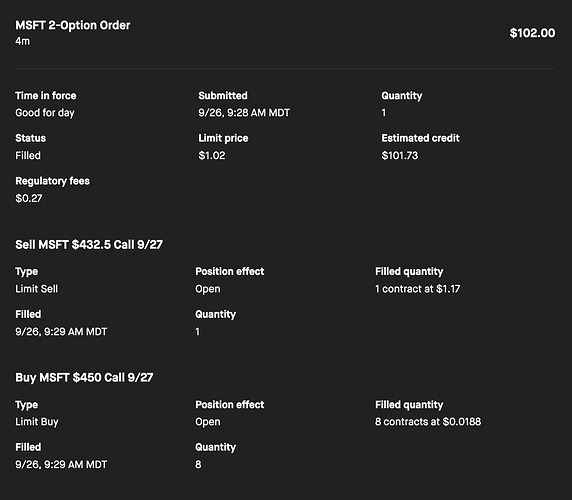

Strategy Setup

- Sell: 1 MSFT $432.5 call option

- Buy: 8 MSFT $450.0 call options

Key Highlights

- Probability of Profit: 64%

- Annualized Return: 189%

- Initial Delta: -40.3 (Balanced risk exposure)

- Theta (Time Decay): $26.0 (Benefits from time decay)

- Vega (Volatility Sensitivity): -5.7 (Profits from decreasing volatility)

Market Context

Microsoft remains a powerhouse in AI and cloud services but faces intensifying competition and regulatory scrutiny. Recent strategic investments signal sustained growth, even as stock prices exhibit short-term volatility.

Current Metrics

- Stock Price: $432.11

- Monthly Movement: +4.4%

- Quarterly Movement: -3.3%

- Trading Volume: Low (11th percentile), with call options 58% more active than puts, indicating potential pricing inefficiencies.

Recent News Catalysts

- Three Mile Island Agreement: Securing nuclear power for AI operations highlights Microsoft’s commitment to sustainable growth amidst rising operational costs. CGTN, Sep 22, 2024

- Antitrust Action by Google: Regulatory tensions escalate as Google challenges Microsoft’s dominance in cloud services. NDTV Profit, Sep 25, 2024

- $60B Share Buyback: A significant buyback could bolster short-term stock performance. [Markets.com, Sep 22, 2024](https://markets.com)

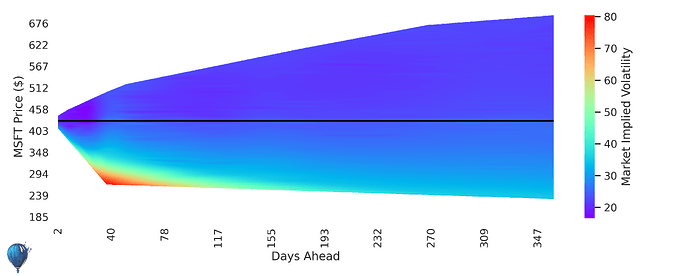

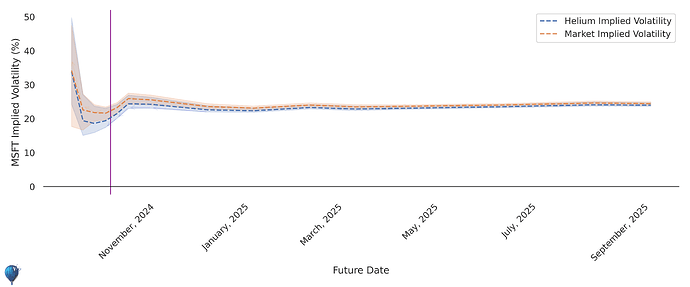

Volatility Insights

Implied Volatility

Helium’s analysis shows implied volatility is lower than market estimates, suggesting current call options may be overpriced. Most volatility projections (17-22%) remain stable through 2025, supporting a short volatility approach.

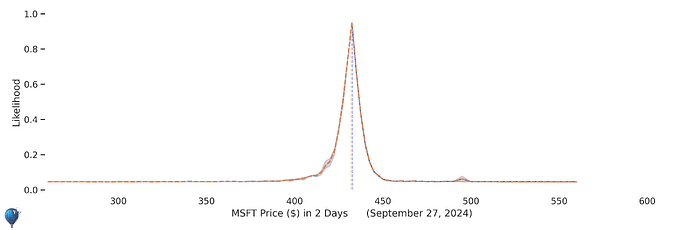

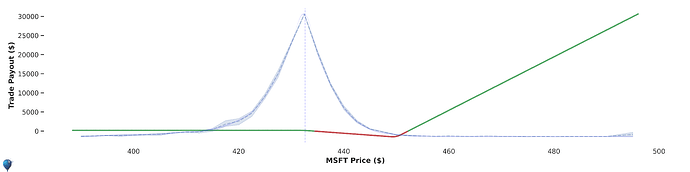

Profit Potential

Expected Outcomes

The probability distribution indicates MSFT will likely stay around $432, minimizing the chances of breaching the $450 strike. This stability, combined with Helium’s $38 edge over market expectations, enhances the trade’s attractiveness.

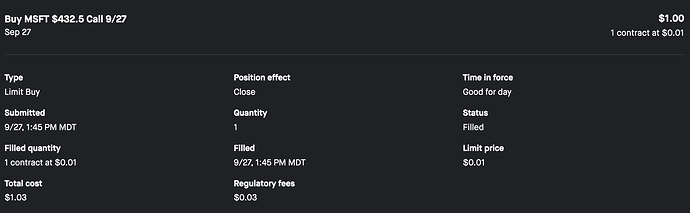

Payout Structure

Profits are realized if MSFT remains below $450. The strategy balances potential gains with limited risk exposure, ensuring favorable outcomes under most scenarios.

Conclusion

This options strategy on Microsoft leverages lower-than-expected volatility and strategic market positioning to offer an impressive annualized return of 189%. With a solid probability of profit and effective risk management, it stands out as a robust choice for traders seeking to capitalize on short-term market conditions.

Dive deeper into this strategy and optimize your trades with Helium Trades.