This guide gives a brief overview of Helium Trades, featuring trading and usage tips to help you take full advantage of the platform. View Video Tutorials.

Navigating Helium

Stock Models

Most Accurate Stock Forecasts based on model ability to predict future price (Helium Score)

Bullish Models

Stocks Helium is Bullish On ![]()

Short Volatility

Optimized Short Options Spreads. Sell market insurance with edge.

Long Volatility

Optimized Long Options Spreads. Highly asymmetric payouts.

Balanced News Feed

Ideologically balanced, customizable news feed

Digital Asset Models

Most Accurate Digital Asset Forecasts based on model ability to predict future prices

All our models are trained and tested every trading day (you can see the last updated date at the bottom of models).

To follow stocks/digital assets in your balanced news feed, turn on AI trading tips, and fully customize your feed, click Customize on the top menu when logged in.

Understanding Price Forecast Charts

How do I know if a model is “good?”

Model accuracy can be quickly gauged by the Helium Score, where values range from 0 to +1 (+1.0 is a perfect score and 0 is terrible). The higher the helium score, the more confident the model is in its prediction ability. Helium score is the average correlation between what the model thought would happen and what actually happened.

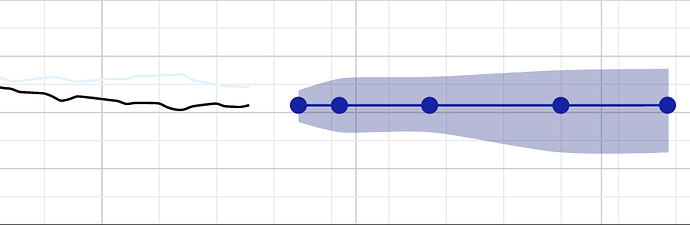

Black Line: The black line is stock closing price (EOD price for Digital Assets). Hover your mouse for exact numbers. Click and drag to zoom in! Right click to zoom out.

Light Blue Line: The light blue line is Helium’s previously made price forecasts made a certain number of days before. Compare the light blue points (what the model predicted) to the black line (what actually happened) to gauge past performance.

When the light blue line tracks closely with the black line and a model has a high “Prediction vs Actual Correlation” value, this means a model has a better track record of predicting future returns.

Green/Red/Blue Cone: The green/red/blue cone is the model’s price prediction for the future in the form of a 80% confidence range. If the model is bullish, it will be green. If the model is bearish, it will be red. If it’s neutral on future price, it will be blue. Since it’s a 80% confidence interval, we can expect the interval to be wrong about 20% of the time.

For a more technical overview of Helium’s charts, click the blue “How to Interpret” button in the top left corner of every model.

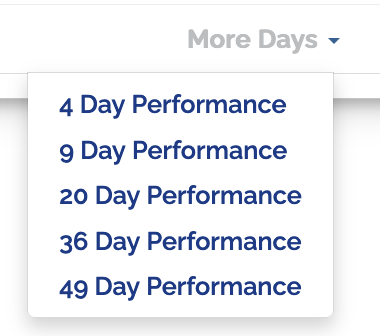

Prediction Performance over Different Time Periods

Each tab indicates model performance made a number of days before. For example, under “4 Day Performance,” the blue line will represent 80% confidence forecasts made 4 days prior. Tabs with green values for Prediction vs Actual Correlation and other metrics indicate a more confident model. Values in red indicate a low performing model, which means that predictions and recommended trades have a poorer track record.

Following Stocks/Digital Assets

To add a particular forecast to your Helium news feed, add the ticker symbol in Customize under “Stocks/Digital Assets.” Additionally, you can enable email notifications for the stocks you follow and we’ll email you when our models expect a price move.

Understanding the News Feed

Diversify your perspectives: Balanced Information Feed

Diversify your perspectives: Balanced Information Feed

Helium aggregates and summarizes from diverse, high-quality sources so that you can understand the bigger picture. Think bigger and read smarter.

See our balanced news sources and evaluate media bias per source.

Customize your Helium account

In addition to Helium Stories, we’ll show you relevant, interesting news from across the web. The fire emoji counts social media shares so you can understand article impact. Customize what type of content you see from different categories, as well as add your own RSS feeds. Follow custom keywords to keep up on your interests. Unlike other feeds, Helium allows you to follow any keyword phrase you want instead of following users/pages.

Limit the number of items in your feed to reduce addiction. There’s also memes and a daily/weekly Memail you can sign up for under Customize!

With Helium’s news feed, you can keep up with everything from Basketball to Quantum Computing.

Search Engine

Use our lightweight search engine that doesn’t track you to research investments, ask questions, read news, understand media coverage over time, and explore new ideas. Helium users get access to AI news summaries for every search query. Helium tracks news media bias over time for sources so you can see the full picture.

How Can I Use Helium Models to Make Trades?

Helium’s models enable you to pursue a variety of trading strategies depending on your comfort with risk. To get inspiration on options trading strategies, take a look at our Short Volatility and Long Volatility.

Helium’s trading strategies offer One Click Trade Execution, an automatic limit order algorithm to help get options filled at attractive prices.

Books can be the best options trading resources of all as well as Youtube videos and the Options Starter Pack to help you trade options successfully.

Remember: *When making your own trades, you should not follow Helium’s recommendations verbatim (especially for our options models). You should trade according to how much downside risk is acceptable and never put up more than you’re willing to lose. Helium is for information purposes only.

Questions:

We’ll answer all of your questions: contact [at] email.heliumtrades.com

*Disclaimer: Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Helium Trades is not responsible in any way for the accuracy of any model predictions or price data. Any mention of a particular security and related prediction data is not a recommendation to buy or sell that security. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Helium Trades is not responsible for any of your investment decisions, you should consult a financial expert before engaging in any transaction.