Welcome to Helium’s first trading guide. In this tutorial, we’ll walk you through our thought processes and trading strategies, including how last week we earned $112.27 to donate to the Sierra Club Foundation.

What we did at a high level: We sold insurance on two stocks, insuring them against large price movements.

Diving a little deeper: For our two stocks of interest, we opened iron condors expiring in 45 days. To decrease our risk, we only held these options for four days.

Let’s get started.

Finding Good Trade Inspirations from Helium

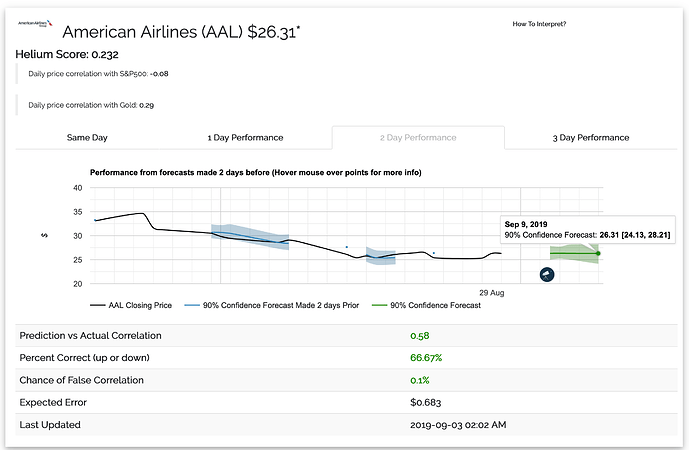

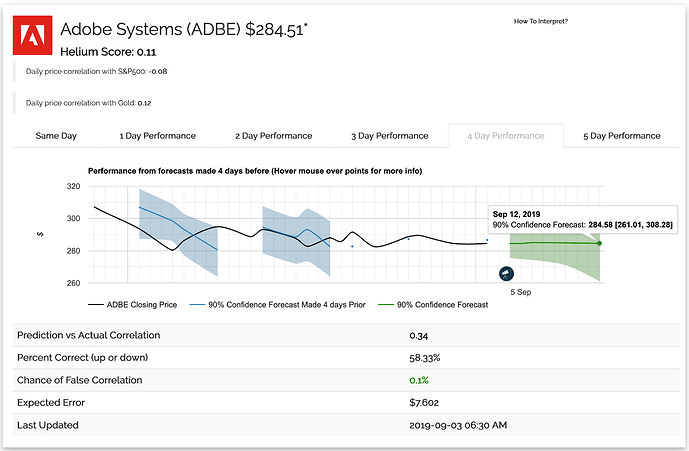

Looking at Helium’s Top Stock Predictions, we saw two models that look tradable: AAL & ADBE.

What made these models stand out?

-

High Helium Score: If a model has a higher Helium score, the model is more confident in its prediction ability.

-

Decent Correlation over longer time horizons: “Prediction vs Actual Correlation” is the correlation between the model’s predictions and the actual stock price. Higher, positive values indicate more accurate performance.

The 90% confidence forecast means the model thought the price would be between the two values with 90% confidence, meaning it expects to be wrong about 1/10 times. We used this to inspire our trades, but it’s important to remember not to follow the models literally, especially models with low Helium and correlation scores. Helium models help guide us for potential trades, but they don’t tell us exactly what strike prices to use. If you don’t apply appropriate risk management to your trades, you will be unsuccessful.

First Trade: AAL

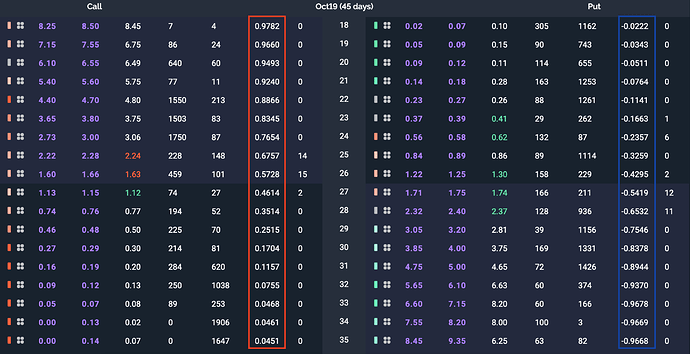

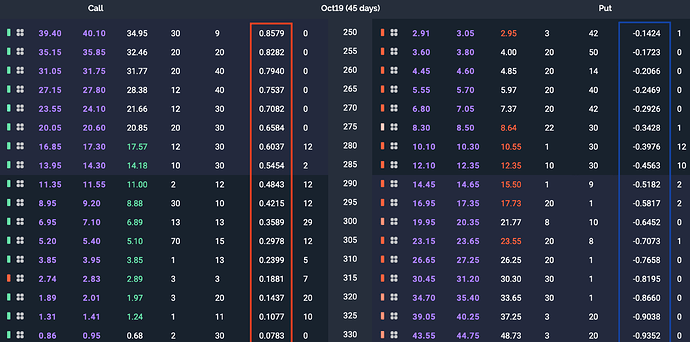

September 3 morning: Here’s what the AAL options chain looked like for options expiring in 45 days:

On the call side, let’s look at the delta values (red box). Delta can be used as an inexact indicator of what the market thinks the probability is (at the given moment) of the option expiring in the money. To keep the risk on this trade down, we sold the $30 call (delta = 0.17) and bought the $33 call (delta = 0.05). It’s helpful to think of selling the 0.17 delta as making a trade with about a 17% chance of failure if we held these options until expiration (which we didn’t because we only planned on holding them for up to a week).

On the put side (blue box), we sold the $22 put (delta = -0.11) and bought the $19 put (delta = -0.03). The market thought that if we held these two options until expiration, there would be about an 11% chance of failure.

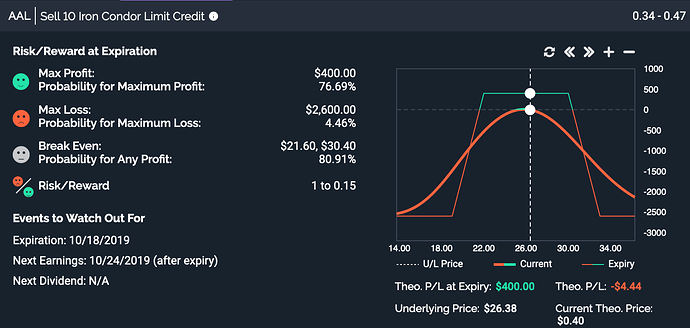

Now that we defined all four options of the iron condor, we looked at E*trade’s Snapshot Analysis:

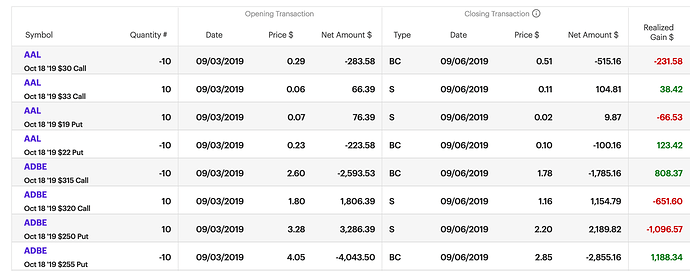

A quick, back-of-the-napkin style estimate of return is ($400 upside) x 0.7669 odds of success — ($2600 downside) x 0.0446 odds of success = + $190.80. However, since we planned on not holding until expiration, our odds were much better than this (we only held these for four days, not 45 days). Since we were comfortable with the potential to lose up to $2600 on this trade, we pulled the trigger. After executing a limit order halfway between the bid and ask price, on the call side we sold the $30 strike for $283.58 and bought the $33 strike for $66.39. On the put side, we sold the $22 strike for $223.58 and bought the $19 strike for $76.39. You can think of the options that we bought as us buying insurance on the insurance that we sold in order to cap both our potential upside as well as our potential downside.

Second Trade: ADBE

Also September 3 (morning): Here’s what the ADBE options chain looked like for options expiring in 45 days:

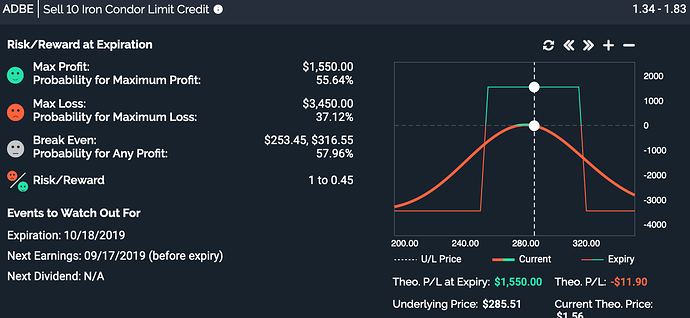

On the call side, we sold the $315 strike (delta = 0.18). On the put side, we sold the $255 strike (delta = -0.17). Since ADBE is a more expensive stock (more money at play), we reduced our risk by buying more expensive insurance on the insurance that we sold. To do this, we bought the $320 call (delta = 0.14) and the $250 put (delta = -0.14). Here’s the snapshot analysis:

By only holding for up to a week, we increase the odds of success and don’t have to deal with next earnings on the 17th. We’re comfortable with the potential for a max loss of $3450, so we sold the $315 call for $2593.53, bought the $320 call for $1806.39, sold the $255 put for $4043.50, and bought the $250 put for $3286.39. Just like the previous trade, the success of this trade depended on the price of the underlying staying in between the strike prices of the two options we sold and implied volatility not increasing too much. Ideally, all four options lose value over time and we keep our initial credit (since we sold expensive options and bought cheaper ones).

Managing Our Trades

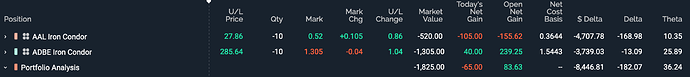

September 4 Midday:

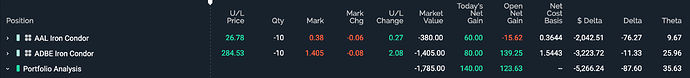

Up $123.63. Nothing looked troublesome, so we left it alone.

September 5 Afternoon:

Up $83.63. We left it alone again.

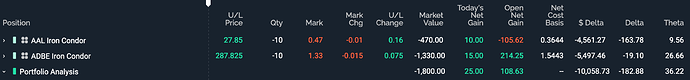

September 6 Midday:

Up $108.63. We could have held longer, but holding longer means more risk because there’s more time for the stock price to move outside our short strikes or implied volatility to increase. To keep things small this time around, we decided to close out by the end of the day.

September 6 Before Market Close:

To close out our positions, we needed to buy back the options we sold and sell the options that we bought. Total realized profit: $112.27. Here’s the final results:

By trading small and using a defined-risk strategy like the iron condor, we were able to reduce downside risk (while also limiting potential profits).

Donating Profits

We donated the $112.27 to the Sierra Club Foundation. For future trading guides, we’ll let you vote on your favorite nonprofit/charity.

“The Sierra Club Foundation promotes climate solutions, conservation, and movement building through a powerful combination of strategic philanthropy and grassroots advocacy.”

Until next time,

Helium Trades

*Disclaimer: Nothing on HeliumTrades or our blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Helium Trades is not responsible in any way for the accuracy of any model predictions, price data, or trading. Any mention of a particular security and related prediction data is not a recommendation to buy or sell that security. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Helium Trades is not responsible for any of your investment decisions. You should consult a financial expert before engaging in any transaction.