Harness the current stability of the Dow Jones Industrial Average with a strategic options trade designed to capitalize on limited market movement. Leveraging Helium’s AI-driven insights, this approach offers high annualized returns while managing risk effectively.

Trade Overview

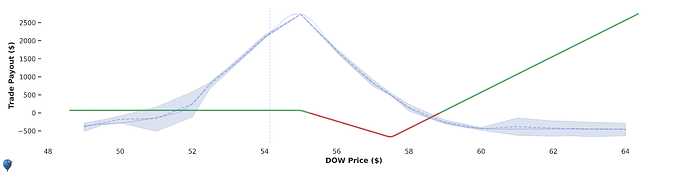

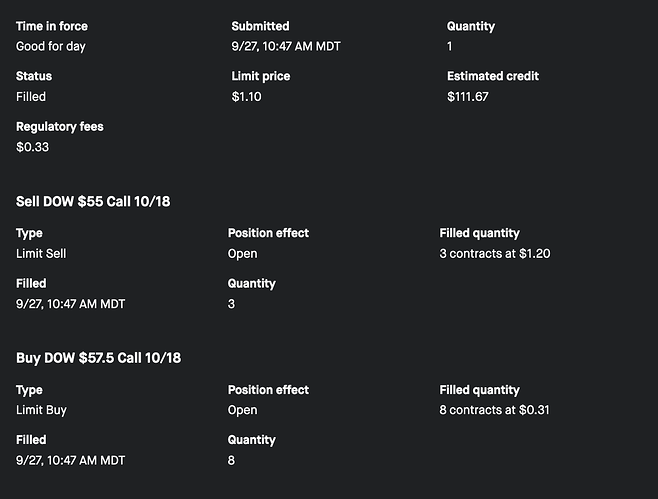

| Action | Options | Strike Price | Delta |

|---|---|---|---|

| Sell | 3 Call Options | $55.0 | -0.49 |

| Buy | 8 Call Options | $57.5 | +0.17 |

- Expiration: October 17, 2024 (22 days)

- Annualized Return: 73%

- Potential Return: 18%

- Probability of Profit: 72%

- Expected Edge: $40

Balanced risk and reward profile tailored to current market conditions.

Why This Strategy?

Market Sentiment

The Dow is currently trading at $54.71, exhibiting flat price action amid geopolitical tensions and subdued trading volume. Helium’s AI forecast predicts a slight bearish trend (-0.28%), suggesting limited volatility over the next few weeks.

Volatility Insights

Helium’s analysis reveals that implied volatility for the Dow is slightly below market averages. This indicates that options may be fairly priced or even overvalued, presenting an opportunity to profit from a short volatility stance.

Risk and Reward

This strategy involves selling call options to collect premiums while buying higher strike calls to cap potential losses. This balance ensures defined risk exposure and aligns with the forecasted stable to slightly declining market conditions.

- Vega (Volatility Risk): Managed to benefit from expected lower volatility.

- Theta (Time Decay): Positive, as options lose value over time, enhancing profitability.

Conclusion

This DOW options trade leverages Helium’s robust AI forecasts and historical data to offer a high annualized return of 73% with a manageable risk profile. It’s ideal for traders anticipating stability or a slight decline in the Dow over the next three weeks.

Explore the full analysis and detailed forecasts at Helium Trades Forecast for DOW.

Happy trading! Utilize Helium’s comprehensive tools for deeper insights and strategic planning.