Citigroup (C) is positioned uniquely amid evolving economic conditions. This options strategy capitalizes on a bullish short volatility outlook, with protection against significant downturns. Let’s explore the rationale and execution of this trade, expiring on November 15, 2024.

Current Market Snapshot

- Price: $64.51

- Annualized Return Potential: 105%

- Probability of Profit: 67%

- Expiration: November 15, 2024

Citigroup has shown robust growth over the past year, despite facing regulatory and restructuring challenges. Notably, trading volume favors call options by 92%, indicating a bullish market sentiment.

Market Context

Global uncertainty, particularly geopolitical tensions in the Middle East, impacts Citigroup’s operations in regions like Lebanon. However, strategic initiatives such as partnerships with Google Cloud for AI modernization demonstrate strength and adaptability, fostering resilience and innovation.

Trade Strategy: Sell Volatility with Long-Tail Protection

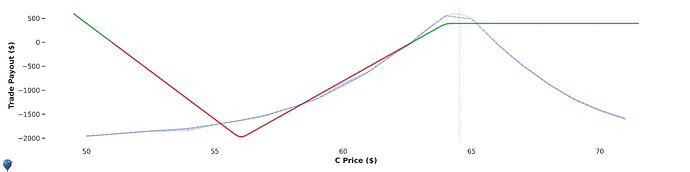

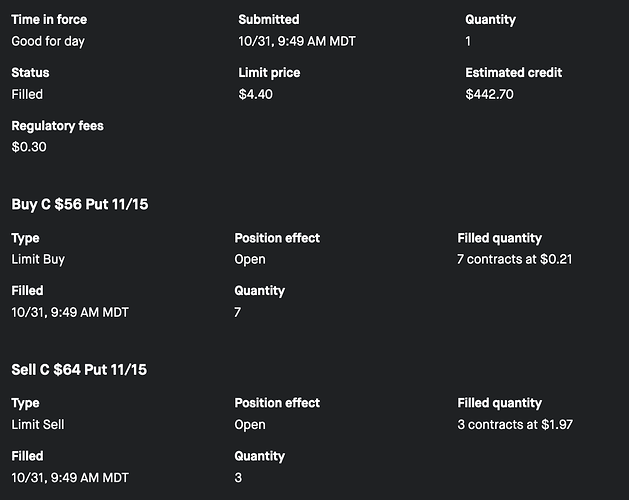

Trade Components

- Sell 3 Put Options at $64.00 strike (Delta: -0.44)

- Buy 7 Put Options at $56.00 strike (Delta: -0.06)

- Expiration Date: November 15, 2024

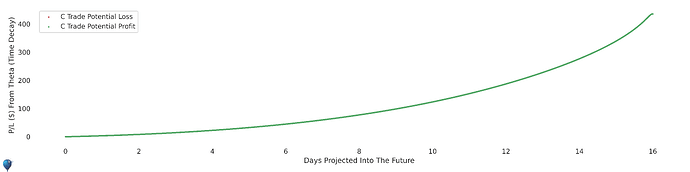

- Potential Return: 22% over 16 days

Why This Trade?

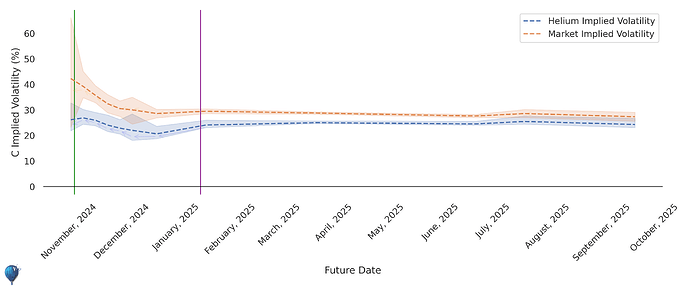

Helium’s implied volatility analysis shows lower projected volatility compared to the market, making Citigroup’s options undervalued. By selling higher-volume puts and purchasing deeper out-of-the-money puts, this strategy benefits from time decay and potential stability in Citigroup’s stock price.

Risk and Reward Profile

The trade offers substantial profit if Citigroup’s price remains stable or experiences a slight decline, while the purchased puts limit downside risk.

Sensitivity Factors

- Theta (Time Decay): +$2.8

- Benefits from the erosion of option value as expiration approaches.

- Vega (Volatility): -$4.5

- Profits from decreasing implied volatility.

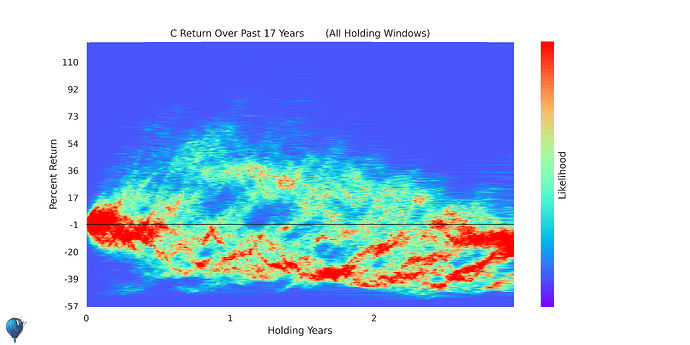

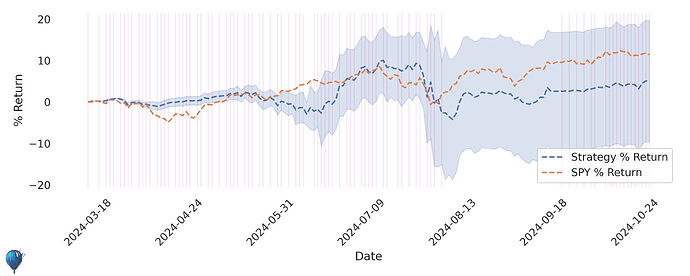

Historical Edge

Key Considerations

- Regulatory Risks: Ongoing changes could impact Citigroup’s operations.

- Geopolitical Stability: Tensions in key regions remain a risk factor.

However, Citigroup’s proactive cost management and strategic pivots mitigate these risks, providing a buffer against adverse market movements.

Conclusion

This Citigroup options strategy leverages Helium’s analytical insights to exploit undervalued volatility, offering a high annualized return with controlled risk. By selling puts and securing long-tail protection, traders can benefit from a bullish outlook while safeguarding against significant downturns.

Explore more details and refine your strategy with Helium’s Citigroup Forecast.