Unlock a strategic options play for Applied Materials (AMAT) that blends market insight with robust risk management. Leveraging Helium’s latest forecasts, this bullish put spread aims to benefit from stable or rising stock prices while minimizing downside risk.

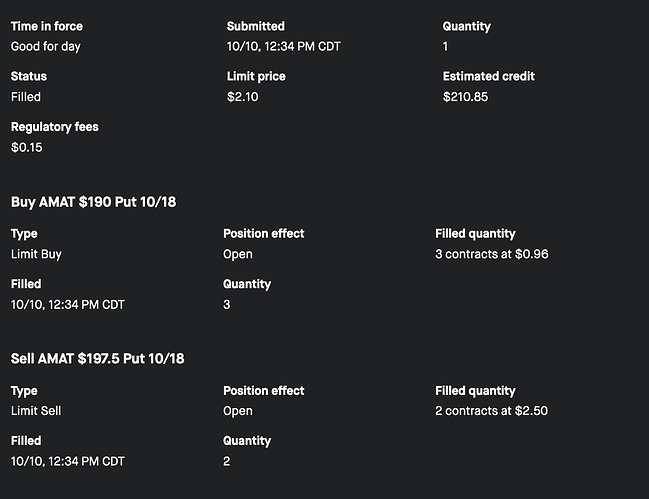

Trade Snapshot

Strategy Overview

- Sell 2 Put Options at $197.5 (Delta: -0.39)

- Buy 3 Put Options at $190 (Delta: -0.22)

- Expiry Date: October 20, 2024

Why This Trade?

With AMAT trading at $205.06 as of October 09, 2024, the current bullish sentiment and strong growth trajectory make this spread a compelling choice. The strategy profits if AMAT maintains its upward momentum or stays above the $197.5 strike, aligning with Helium’s 61% probability of success and a promising 114% annualized return.

Market Context

Positive Drivers

- Robust Growth: AMAT has surged +984.1% over the past decade, underscoring its resilient market position.

- AI and Infrastructure Boom: Increasing demand for AI and data infrastructure supports AMAT’s long-term prospects.

- Bullish Sentiment: Recent trading volumes favor calls, reflecting investor optimism.

Potential Risks

- Regulatory Hurdles: Changes in regulations could impact growth forecasts.

- Competitive Pressures: Intensified competition in Asia may challenge AMAT’s market share.

Visual Insights

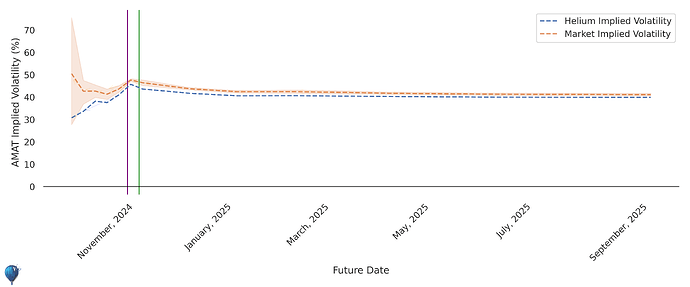

Volatility Term Structure

Helium’s analysis indicates lower implied volatility in the near term compared to market expectations. This divergence suggests a favorable environment for selling puts, anticipating reduced volatility moving forward.

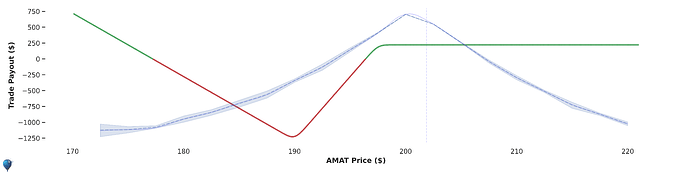

Risk Profile

The payout graph highlights a strong probability of profit, with gains realized if AMAT stays above the breakeven point. Risk is managed through the protective puts, ensuring limited downside exposure.

Why It Works

This put spread strategy effectively balances potential rewards with controlled risks. By selling higher-strike puts and buying lower-strike puts, you capture premium income while safeguarding against significant declines. Helium’s data-driven insights reinforce the trade’s edge, offering confidence in its annualized return potential.

Stay Informed

For detailed forecasts and continuous updates, visit Helium’s AMAT Forecast. Engage with the community below to share insights and refine your trading strategies.

Trade thoughtfully, manage risks wisely, and harness data-driven decisions to navigate AMAT’s promising trajectory.