Date: October 17, 2024

Options Expiry: October 25, 2024

Wells Fargo (WFC) is currently under significant regulatory scrutiny and operating in a stable yet cautious market environment. These factors create an ideal scenario for a bearish short-volatility options strategy aimed at generating high annualized returns with controlled risk.

Strategy Overview: Short Volatility with Protective Upside

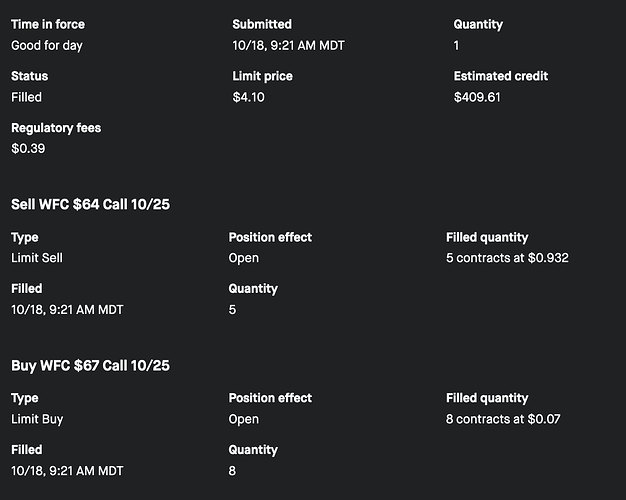

Trade Setup

- Sell 5 Call Options @ $64 strike (Delta: 0.5)

- Buy 8 Call Options @ $67 strike (Delta: 0.1)

Key Metrics:

- Probability of Profit: 70%

- Potential Return: 42% (Annualized 283%)

- Initial Theta: $14.4 (benefits from time decay)

- Initial Vega: -5.3 (low sensitivity to volatility changes)

Learn more about this strategy on Helium Trades.

Market Context

WFC’s stock is holding steady around $63.89 amidst potential Federal Reserve rate cuts and ongoing regulatory challenges. Similar to recent issues faced by TD Bank, these pressures may limit WFC’s short-term growth, making it a prime candidate for a bearish options strategy.

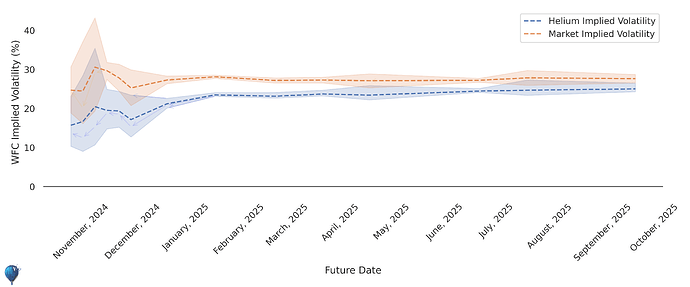

Implied Volatility Trends

The declining implied volatility indicates decreasing market uncertainty, which supports our short-volatility approach. Helium’s projections align with this trend, suggesting low near-term volatility.

Why This Trade Makes Sense Now

- Regulatory Headwinds: Continued scrutiny may suppress WFC’s stock performance.

- Stable Volatility: Lower volatility reduces the risk of unexpected price spikes.

- Options Flow: Higher call volume indicates bullish sentiment, allowing us to benefit from potential market complacency.

Risk and Return Profile

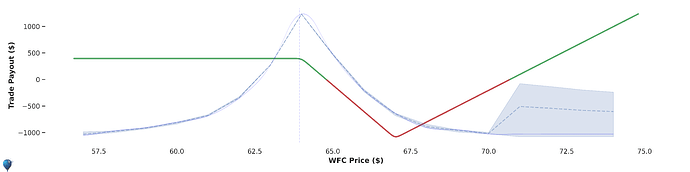

Trade Payout Structure

The payout graph demonstrates a favorable risk-reward balance. The bought calls at $67 provide a safety net against significant price increases, while the sold calls capitalize on the current stability.

Volatility and Time Decay

- Minimal Volatility Risk: The strategy is designed to be resilient against minor volatility shifts.

- Positive Theta: Time decay works in our favor, increasing the trade’s profitability as expiration approaches.

Conclusion

This bearish options strategy on WFC leverages current regulatory challenges and stable market conditions to offer an attractive annualized return with a solid probability of success. By balancing potential rewards with controlled risks, this trade is well-suited for traders seeking high-efficiency strategies in a nuanced financial landscape.

Explore Helium’s WFC AI Forecast for more insights.