Explore a strategic options trade on Nike (NKE) designed to leverage current market volatility with a focus on risk management and strong potential returns.

Trade Overview

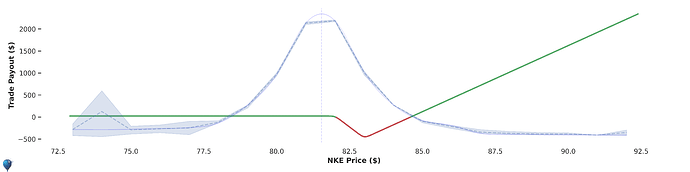

Strategy: Bearish Call with Long Tail Convexity

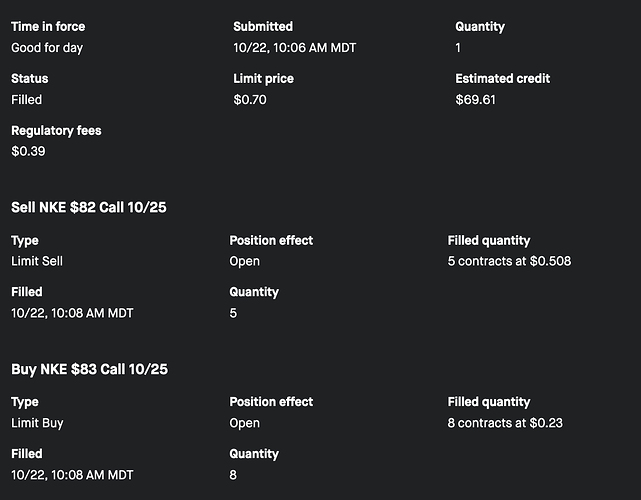

Expiration: October 26, 2024 (4 days from today)

Positions:

- Sell 5 Call Options at $82 Strike

- Buy 8 Call Options at $83 Strike

Annualized Return Potential: 162%

Probability of Profit: 64%

Links: Helium’s NKE AI Forecast

Why This Trade?

Nike is currently experiencing higher implied volatility due to recent market uncertainties. By implementing a bearish call strategy, we aim to benefit from potential volatility compression while maintaining protection against unexpected price movements.

Understanding the Strategy

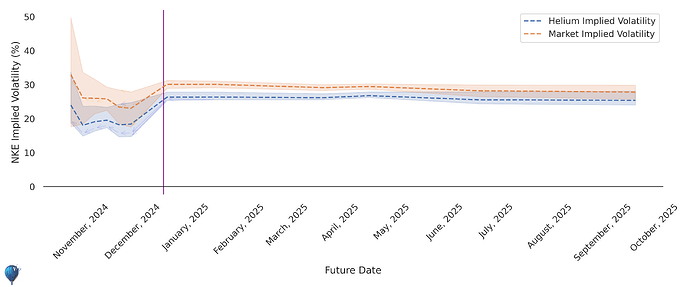

Implied Volatility Insights

Nike’s implied volatility suggests the market expects significant short-term movements. Our strategy profits if volatility decreases, aligning with Helium’s prediction of a calmer risk environment.

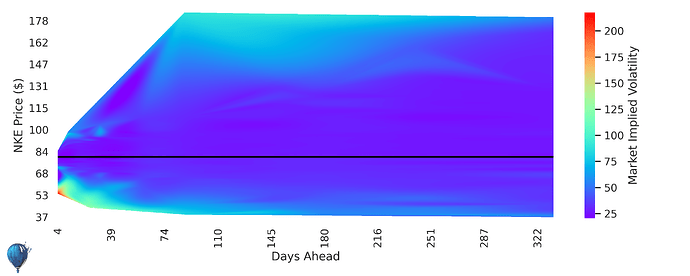

Volatility Surface Analysis

The peak in short-term implied volatility indicates opportunities for traders to exploit near-term price stability. This setup benefits from a reduction in volatility over the next few days.

Catalysts Impacting Nike

Recent price drops in Nike stock are driven by:

- Supply Chain Challenges: Ongoing disruptions affecting product availability.

- Competitive Pressures: Increased competition in the athletic wear market.

- Strategic Shifts: Renewal of NBA partnership signaling long-term growth despite short-term headwinds.

These factors create a favorable environment for a bearish options strategy.

Risk and Reward

Risk Management:

- Limited downside due to long tail convexity from purchased calls.

- Potential loss if volatility spikes unexpectedly.

Reward Potential:

- Expected edge from Helium’s analysis: 33

- Annualized return of 162% based on a 17% potential return over 4 days.

Historical Performance

Nike’s options strategies have consistently outperformed market averages. View Historical Performance

Final Thoughts

This bearish call strategy on Nike leverages current volatility trends and robust risk management to offer substantial annualized returns. By aligning with Helium’s data-driven insights, this trade presents a compelling opportunity to capitalize on Nike’s short-term market dynamics.

For more detailed analysis and continuous updates, visit Helium Trades.

Happy trading!