Access cheap, positive edge trades with nonlinear payouts and high reward to risk ratios. Defined max loss. Optimized daily.

Watch the Video Walkthrough

How Does it Work?

Every day, Helium looks through the universe of all possible debit ratio spreads to find trades that best satisfy a balanced combination of:

1.) High Convexity (gamma) & High Reward:Risk: You can think of this as optimizing for potential acceleration in the value of the option, relative to the price of the underlying asset.

2.) High Market Expected Value (expected value): Helium tries to maximize the expected terminal value of each position, as determined by market prices & Black-Scholes implied probabilities. Helium uses conservative assumptions to reduce the likelihood of false positives.

3.) High Helium Expected Value (expected value): Using highly regularized machine learning on historical options prices, Helium tries to maximize the expected terminal value of each trade.

4.) Small Time Decay (theta): Helium tries to minimize the carrying-cost of being long options. Theta represents the daily money lost by holding an option if nothing else happens.

5.) Helium Uncertainty > Market Uncertainty: By comparing market uncertainty to Helium uncertainty, we can seek out underlyings with potentially under-priced risk.

6.) Low Price: Looking for cheap convexity means optimizing for cheaper options/spreads (less possible max loss).

7.) Long Trade Duration: Helium optimizes for options longer to expiration in order to maximize the time for a big underlying move.

8.) High Maximum Option Lifetime Value: Helium trains an AI to predict maximum price over an options lifetime. Then, it optimizes to maximize this value for the long leg of the option and minimize this value for the short leg.

9.) AI Price Forecasts: Using machine learning price forecasts, Helium weights call options higher on bullish stocks (long delta) and weighs put options higher on bearish stocks (short delta).

10.) Low Implied Volatility Rank: (IVR) Helium is looking for assets with lower IV (relative to yearly highs and lows) in order to take advantage of potential IV expansion from options priced relatively cheaply.

11.) High Liquidity: Helium optimizes for trades with tighter markets as measured by the bid-ask spread.

12.) High Historical Performance: Helium optimizes for models with a historically high risk-adjusted return if you had opened up a new trade every day it was available.

13.) Selling High IV & Buying Low IV: On a relative basis, Helium optimizes for selling options with higher implied volatility and buying options with relatively low implied volatility.

One Click Trade Execution: Automatic limit order algorithm to get filled at attractive prices

Trading Helium’s Long Volatility

To find the options, click the purple “Long Volatility” buttons on Long Volatility Forecasts.

These trades are optimized daily from market prices to find potentially profitable trades

Example Trade & Risk Profile

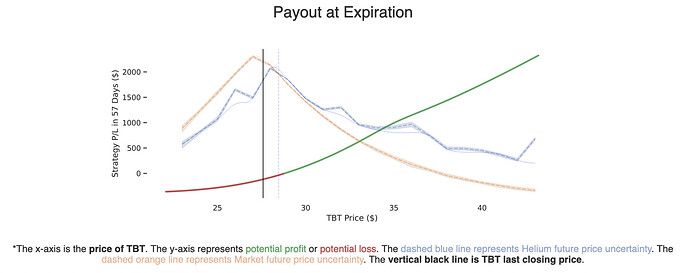

Most of Helium’s Long Volatility trades are ratio spreads, which means buying a different number of options than we sell. In the below example, we are buying 2 call options struck at $27 and selling 1 call options struck at $35.

Risk Metrics

Delta Risk

Risk from underlying movement. In this example, the trade will be profitable if the underlying price is above $28 at expiration.

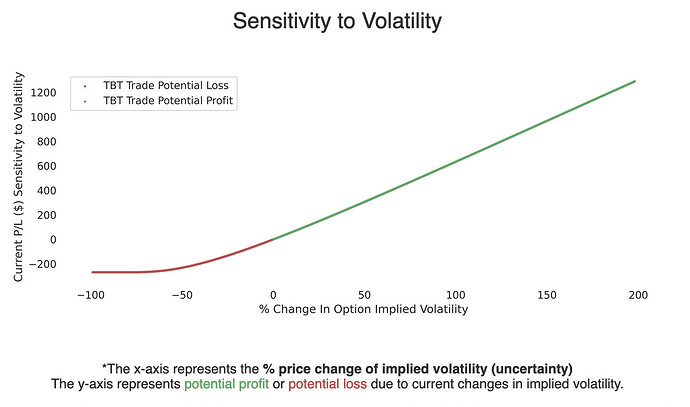

Vega Risk

Risk from increases in uncertainty right now. In this example, the trade is initially long volatility.

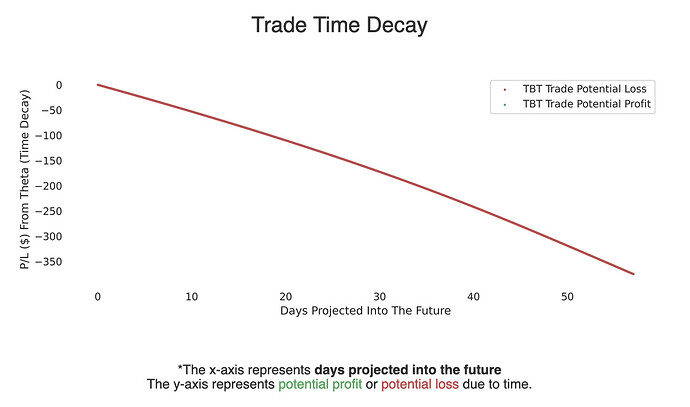

Theta Risk

Risk from time decay if nothing else happens. In this example, we are short carry (the price of being long options).

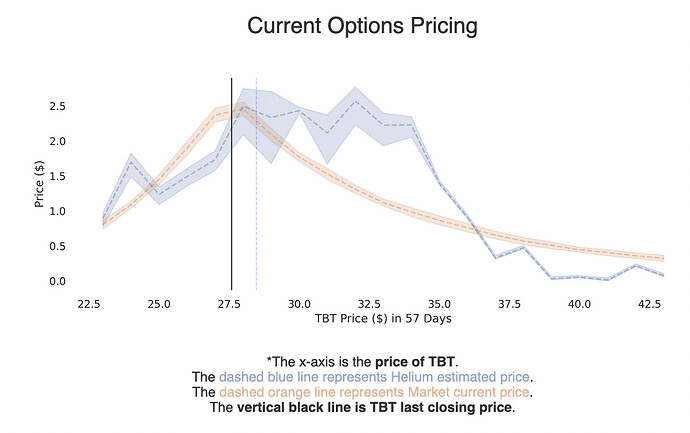

Current Options Pricing

Market vs Helium AI options prices. Discrepancies are used to identify potential mis-pricings and optimize trades.

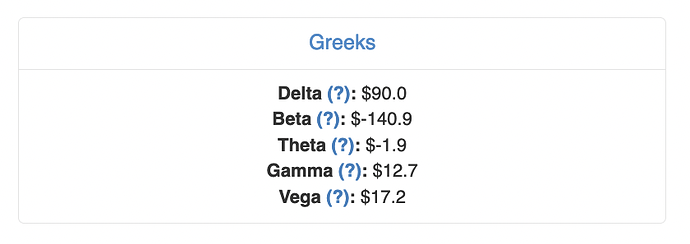

Greek Risks

Current greek risk metrics, where Beta is delta-weighted to SPY

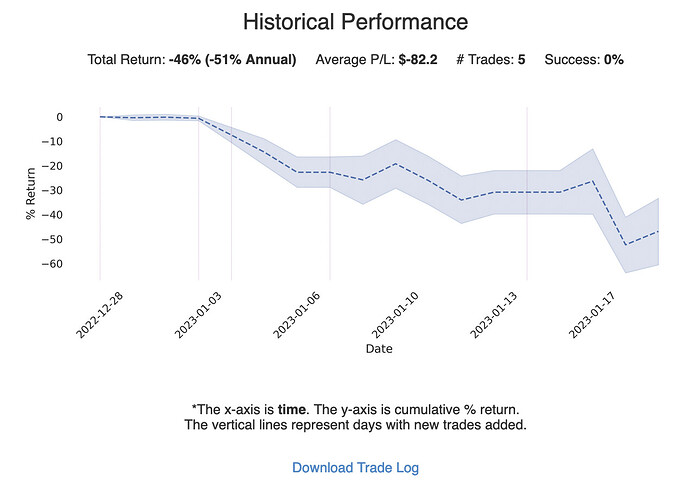

Historical Performance

Cumulative return if you had opened a trade every day.

See Also: Short Volatility: Using Helium to Sell Options for selling options

*Disclaimer: Nothing on Helium Trades or our blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Helium Trades is not responsible in any way for the accuracy of any model predictions, price data, or trading.Any mention of a particular security and related prediction data is not a recommendation to buy or sell that security. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Helium Trades is not responsible for any of your investment decisions. You should consult a financial expert before engaging in any transaction.